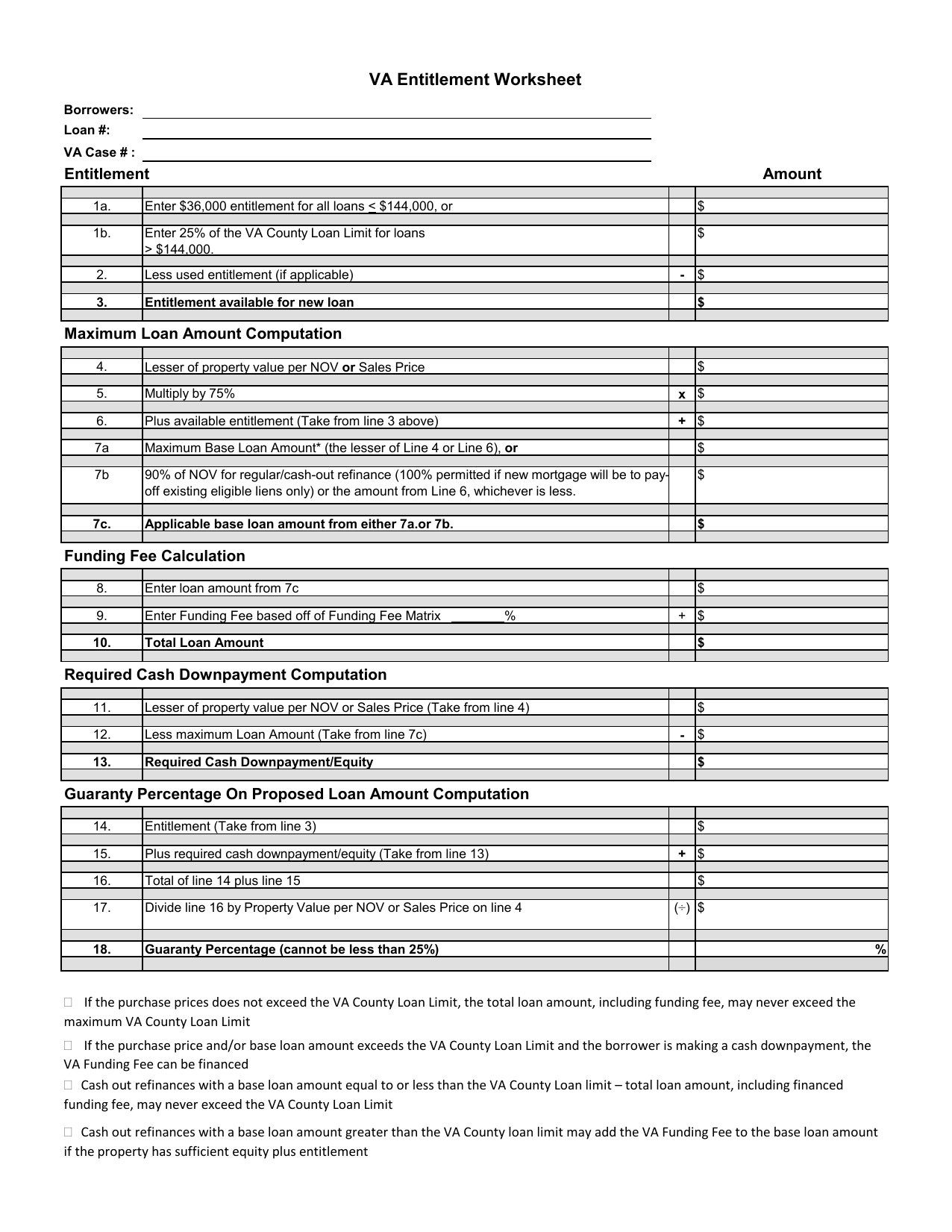

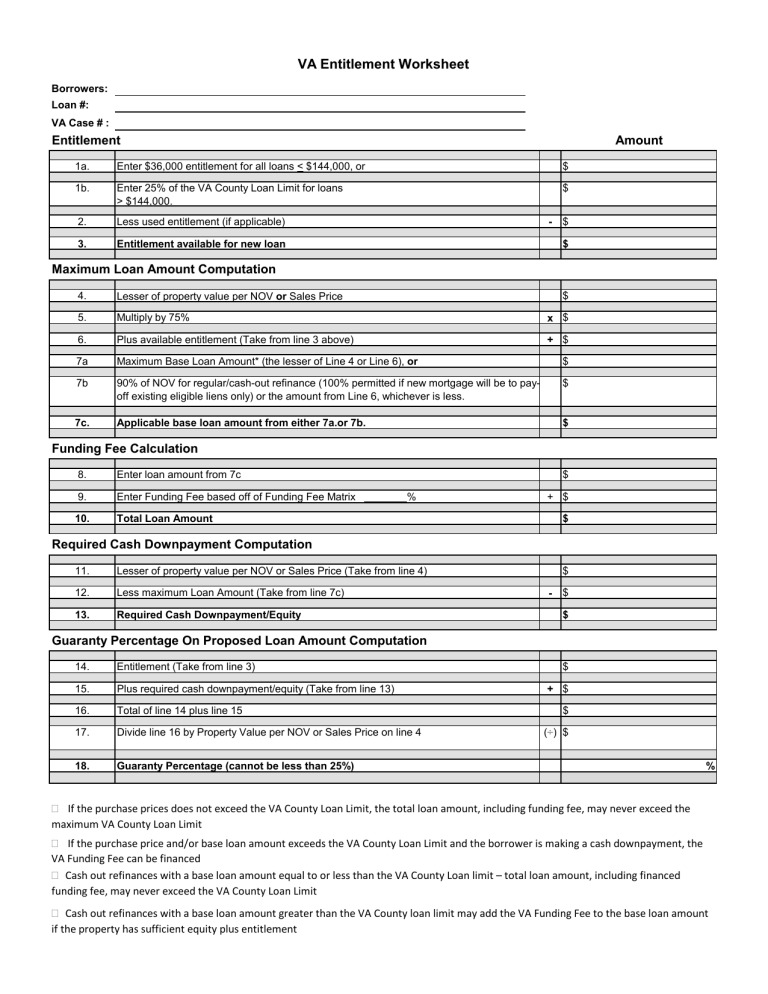

39 va loan amount worksheet

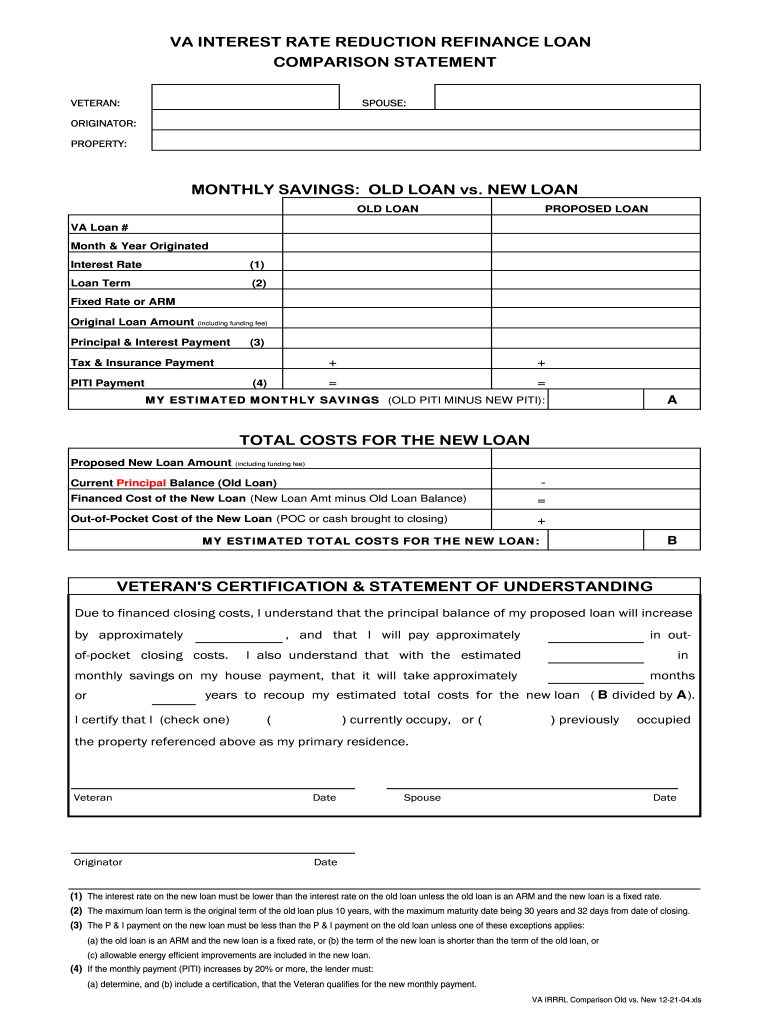

Loan Guaranty: Revisions to VA-Guaranteed or Insured Interest … 01/11/2022 · In paragraph (a)(11)(ii), VA proposes to require lenders to provide veterans with an initial loan comparison disclosure and a final loan comparison disclosure of the following: the loan payoff amount of the IRRRL, with a comparison to the loan payoff amount of the loan being refinanced; the type of interest rate, whether a fixed-rate, traditional adjustable-rate, or hybrid … What Is The Maximum Va Loan Amount - UnderstandLoans.net The standard VA loan limit in 2022 is $ 647,200 for most U.S. counties, increasing from $ 548,250 in 2021. VA loan limits also increased for high-cost counties, topping $ 970,800 for detached houses. VA loan limits do not represent a ceiling or maximum loan amount.

VA Loan Entitlement: What it is & Why it is Important The VA loan limit for much of the U.S. is $647,200 (this exceeds $900,000 in high-cost counties). That means most Veterans have $161,800 in VA entitlement ($647,200 / 4). If you purchase that same home in the example above for $700,000 and are currently using $40,000 of your VA entitlement, you'll need to bring $53,200 to the table.

Va loan amount worksheet

Loan Guaranty VA Circular 26-22-16 requires lenders to upload the Uniform Loan Application Dataset (ULAD), and the Uniform Closing Dataset (UCD) for loans called for FFLR. Lenders should upload the ULAD and UCD, in addition to the documents required in VA's stacking order, into WebLGY correspondence using the document upload function. Va Refinance Max Loan Amount Calculator 2022 | Cuanmologi Va Loan Amount Worksheet Promotiontablecovers from promotiontablecovers.blogspot.com. Compare rates and get your quote online now The conforming loan limit where you're relocating is $647,200. However, va loan limits are a max on what you can buy without a down payment. +25 Va Max Loan Amount Worksheet Ideas | US Folder The new va loan limit for 2019 is 484350. Va Maximum Loan Amount Calculation Worksheet — from db-excel.com However, the lender generally needs a 25% guaranty. The new va loan limit for 2019 is 484350. Hannah frahm last modified by: Source: Of property value per nov or sales price $ 5.

Va loan amount worksheet. VA Loan Calculator - The Military Wallet Use this VA loan calculator to estimate your monthly mortgage payments. Simply insert your military status, purchase price, downpayment and any tax and homeowner's insurance information, if you have that information handy. VA Loan Calculator VA Loan Type Home Value $ Down Payment (20.0%) $ Set to: Are you VA Disabled? Mortgage loan - Wikipedia Mortgage loan basics Basic concepts and legal regulation. According to Anglo-American property law, a mortgage occurs when an owner (usually of a fee simple interest in realty) pledges his or her interest (right to the property) as security or collateral for a loan. Therefore, a mortgage is an encumbrance (limitation) on the right to the property just as an easement would be, but … Chapter 3. The VA Loan and Guaranty Overview - Veterans Affairs Maximum Loan Amount VA has no specified dollar amount(s) for the “maximum loan.” The maximum loan amount depends upon: • the reasonable value of the property indicated on the Notice of Value (NOV), and • the lenders needs in terms of secondary market requirements. 3 of this chapter Downpayment No downpayment is required by VA unless the purchase price … 2023 VA Loan Limits by County - Military Benefits In most of the U.S., the 2023 maximum conforming loan limit (CLL) for single-unit properties is $726,200, a 12.2% increase from $647,200 in 2022. The ceiling loan limit for single-unit properties in most high-cost areas is $1,089,300 - or 150% of the $726,200 loan limit for most single-unit properties. Have a question about VA loan limits?

Using the VA Loan a Second Time - Military Benefits Next, veterans need to multiply their remaining entitlement by four to determine the loan amount they can still borrow without needing a down payment. For the above scenario, $77,600 x 4 = $310,400, which means that this veteran could use the VA loan a second time to purchase a $310,400 home without a down payment. VA Residual Income Charts and Loan Requirements for 2022 VA Residual Income Needed Chart for Loan Amounts of $80,000 and Above For families over 5, add $80 for each additional family member up to seven. How to Calculate Your Residual Income The first step to calculate your residual income is to sum up your total gross monthly income. Remember to include your co-borrower's income if you plan to have one. Conforming Loan Limit Values | Federal Housing Finance Agency The national conforming loan limit value for mortgages that finance single-family one-unit properties increased from $33,000 in the early 1970s to $417,000 for 2006-2008, with limit values 50 percent higher for four statutorily-designated high cost areas: Alaska, Hawaii, Guam, and the U.S. Virgin Islands. VA Jumbo Loans: Rates, Requirements and Down Payment Details VA jumbo loan limits are the same as VA loan limits, which are the same as the conforming loan limits. The base limit for much of the U.S. is $647,200. However, in high-cost counties, the limit can exceed $970,800. See 2022 VA Loan Limits What are VA jumbo loan rates? VA jumbo rates are generally higher than loans under the conforming loan limit.

VA Second-Tier Entitlement - A Comprehensive Guide - MadisonMortgageGuys A veteran and his family purchased a home with a beginning loan balance of $250,000. The home was later sold in a short-sale situation. $250,000 x 25% = $62,500 amount of entitlement used for first home. $127,600 - $62,500 = $65,100 amount of remaining entitlement left for the veteran. VA Loan Calculator - Estimate Monthly Mortgage Payments Use our VA mortgage calculator to quickly estimate your monthly VA mortgage payment for a VA loan or VA refinance loan. VA Loan Calculator First Time VA Loan? Type of Service Purchase Price $ Mortgage Term Down Payment ($) 0% Annual Taxes ($) 1% Interest Rate ($) 5% Annual Insurance ($) $ Monthly HOA $ Want a Copy of the Results? $ 1,680.33 Va Residual Income Worksheet 2020 Worksheet Maker The chart also illustrates the income conditions that the va requires, including residual income requirements for loans below $80,000. table of residual income by region for loan amounts of $79,999 and below over 5 add $75 for each addional member up to a family of seven. if you have a loan amount higher than $80,000, things break down as follows. VA Loan Limit Rules - Military Benefits The VA loan funding fee is on a sliding scale with the lowest fees reserved for first-time VA borrowers, and higher fees for those who have used VA loans before. Prior to the new law, VA loan funding fees for active duty military members buying for the first time were set at 2.15%, with a higher fee for subsequent use set for the same active ...

Mortgage industry of the United States - Wikipedia Mortgage lenders. Mortgage lending is a major sector finance in the United States, and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurers.Mortgages are debt securities and can be conveyed and assigned freely to other holders. In the U.S., the Federal government created several programs, or government sponsored …

VA Loan Closing Costs - Complete List of Fees to Expect Like every mortgage, the VA loan comes with closing costs and fees. VA loan closing costs average anywhere from 3 to 5 percent of the loan amount, but can vary significantly depending on where you're buying, the lender you're working with, seller concessions and more. Skip to Content Skip to Lesson Navigation. Mortgage Research Center, LLC – NMLS #1907. VA …

Va Loan Amount Calculation Worksheet - Adelvina.cyou The Standard Va Loan Entitlement Is Either $36,000 Or 25% Of The Loan Amount. $ subtract any cash payment from veteran. $36,000 $36,000 x 4 = $144,000 additional entitlement*: If the home you are buying is more than your. Va Maximum Loan Amount Calculation Worksheet. Va entitlement worksheet va case #: $101,800 remaining entitlement x 4 =.

Publication 970 (2021), Tax Benefits for Education | Internal … Student loan interest deduction. For 2021, the amount of your student loan interest deduction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). You can’t claim the deduction if your MAGI is $85,000 or more ($170,000 or more if you file a joint return). You can’t deduct as interest on a student loan any …

2022 VA Loan Limits | Rocket Mortgage First, let's look at 25% of the loan amount. It comes out to $120,000 ($480,000 × 0.25). Now let's take a look at the second formula, which is 25% of the county loan limit minus the amount of entitlement that wasn't restored. That comes out to $81,800 ($647,200 × 0.25 - $80,000). The VA guarantees $81,800 because it's the lower of the ...

Understanding Your VA Loan Entitlement | LendingTree As of Jan. 1, 2020, there is no longer a maximum VA loan amount. However, there is a maximum VA entitlement, which is calculated as 25% of your loan amount for any loan over $144,000. You should also note that most lenders won't issue a zero-down loan for more than $417,000 in most states ($625,500 in Alaska, Hawaii, Guam and U.S. Virgin ...

A Guide To VA Loan Entitlement | Rocket Mortgage To find out how much of your entitlement you've used, simply multiply your loan amount by 0.25. Loan amount × 0.25 = entitlement you've already used You'll also need to determine your county's conforming loan limit. In 2021, the baseline conforming loan limit was $548,250. In 2022, the loan limit is $647,200.

VA Residual Income Calculator (2022 Data) - Anytime Estimate Your net income must exceed VA residual area income charts to get a VA loan. VA residual income charts: how much do you need? The Veterans Administration sets residual income requirements based on the amount of the loan, your family size, and your location. For VA loan amounts of $79,999 and below For VA loan amounts of $80,000 and above

VA Loan Guidelines For 2023: VA Mortgage Hub VA Loan Limits & Funding Fee 2023: High Balance VA Jumbo Loans are now available to all eligible vets. 100% financing for loans up to $2mil, higher loans up to $4mil with a low down payment. No monthly mortgage insurance and low VA fixed rates. One-time funding fees are required for most VA home loans.

VA Residual Income Chart And Requirements | Quicken Loans The chart also illustrates the income conditions that the VA requires, including residual income requirements for loans below $80,000. Table of Residual Income by Region for Loan Amounts of $79,999 and Below Over 5 Add $75 for each addional member up to a family of seven. If you have a loan amount higher than $80,000, things break down as follows.

News and Insights | Nasdaq Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more

Joint VA Loans: A Guide | Rocket Mortgage For these borrowers, the VA will pay lenders up to 25% of the loan amount if borrowers stop making their payments. Most veterans or active-duty members of the military qualify for this full entitlement if they've never taken out a VA loan before or if they've paid off a previous VA loan in full and sold the home that loan was used to buy.

Publication 17 (2021), Your Federal Income Tax - IRS tax forms See the instructions for Form 1040, line 30, and the Recovery Rebate Credit Worksheet to figure your credit amount. Who must file. Generally, the amount of income you can receive before you must file a return has been increased. For more information, see the Instructions for Form 1040. Standard deduction amount increased. For 2021, the standard deduction amount has been …

Understanding Your VA Loan Bonus Entitlement VA loan entitlement generally covers 25% of the total loan amount. There are two types of VA loan entitlement: Basic and bonus, which is sometimes referred to as second-tier entitlement. Your Certificate of Eligibility will show your basic VA loan entitlement of $36,000, which guarantees homes up to $144,000.

How To Calculate Va Loan Amount - UnderstandLoans.net Your total entitlement could be $104,250 and a maximum VA loan guaranty of $417,000. Although $417,000 is a common VA loan limit for many counties in the United States, higher VA loan limits exist for counties in parts of the country with higher costs of living. In parts of Hawaii, for example, VA loan limits are more than $700,000.

How To Calculate VA Residual Income | 2022 Charts Residual income charts ensure VA home loan applicants can handle their house payment plus other living expenses. Residual income charts for VA loan amounts above $80,000 Residual income charts for VA loan amounts below $80,000 Calculating your VA residual income VA residual income can be calculated accurately only by your lender's underwriter.

VA Entitlement Calculator | VA Loans for Vets You'll receive $36,000 in basic entitlement from the VA if you're loan amount is under $144,000. The Certificate of Eligibility (COE) informs whether you stil carry Basic Entitlement or not. For example, the VA would always guarantee $36,000 towards the VA Home Loan if the total is below $144,000.

How to Get a VA Loan After Foreclosure and Restore Entitlement If, down the road, the Veteran looks to purchase again in a county with a standard loan limit, they'll only be able to buy a home up to $347,200 without a down payment. The math looks like this: 25% x $647,200 (standard loan limit) = $161,800 $161,800 (basic + bonus entitlement) - $75,000 (lost entitlement) = $86,800 in remaining entitlement

Mortgage-backed security - Wikipedia Common specifications for MBS pools are loan amount ranges that each mortgage in the pool must pass. Typically, high-premium (high-coupon) MBSs backed by mortgages with an original loan balance no larger than $85,000 command the largest pay-ups. Even though the borrower is paying an above market yield, he or she is dissuaded from refinancing a small loan balance …

26 Va Residual Income Worksheet Worksheet Information Surface Studio vs iMac - Which Should You Pick? 5 Ways to Connect Wireless Headphones to TV. Design

Poverty Guidelines | ASPE 12/01/2022 · U.S. Federal Poverty Guidelines Used to Determine Financial Eligibility for Certain Programs HHS Poverty Guidelines for 2022 The 2022 poverty guidelines are in effect as of January 12, 2022.Federal Register Notice, January 12, 2022 - Full text.

+25 Va Max Loan Amount Worksheet Ideas | US Folder The new va loan limit for 2019 is 484350. Va Maximum Loan Amount Calculation Worksheet — from db-excel.com However, the lender generally needs a 25% guaranty. The new va loan limit for 2019 is 484350. Hannah frahm last modified by: Source: Of property value per nov or sales price $ 5.

Va Refinance Max Loan Amount Calculator 2022 | Cuanmologi Va Loan Amount Worksheet Promotiontablecovers from promotiontablecovers.blogspot.com. Compare rates and get your quote online now The conforming loan limit where you're relocating is $647,200. However, va loan limits are a max on what you can buy without a down payment.

Loan Guaranty VA Circular 26-22-16 requires lenders to upload the Uniform Loan Application Dataset (ULAD), and the Uniform Closing Dataset (UCD) for loans called for FFLR. Lenders should upload the ULAD and UCD, in addition to the documents required in VA's stacking order, into WebLGY correspondence using the document upload function.

0 Response to "39 va loan amount worksheet"

Post a Comment