40 1031 exchange worksheet excel

1031 exchange worksheet excel What is a 1031 Exchange? - Real Works. 15 Pics about What is a 1031 Exchange? - Real Works : Worksheets. Like Kind Exchange Worksheet. plantsvszombiesonline Free, 1031 Exchange Worksheet - Fill Online, Printable, Fillable, Blank and also 1031 Exchange Checklist. PlayStation userbase "significantly larger" than Xbox even if … Web12/10/2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised…

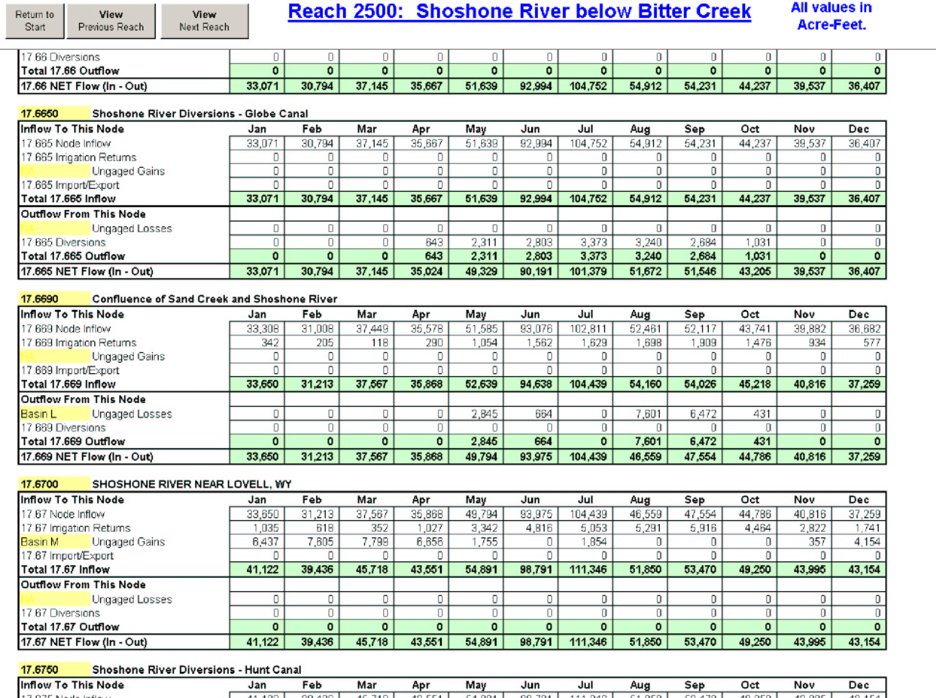

1031 exchange worksheet Like Kind Exchange Worksheet Excel And Irs 1031 Exchange Worksheet . midwest irs. 1031 exchange analysis sample worksheet for irs form 8824 (cont. Section 1031 exchange: the ultimate guide to like-kind exchange. 1031 exchange forms tax form. Random Posts.

1031 exchange worksheet excel

1031 Exchange Worksheet Excel: Optimal Resolution List - UpdateTrader List the best pages for the search, 1031 Exchange Worksheet Excel. All the things about 1031 Exchange Worksheet Excel and its related information will be in your hands in just a few seconds. 1031 Exchange Calculator | Calculate Your Capital Gains 1031 Exchange Calculator | Calculate Your Capital Gains Capital Gains Calculator Realty Exchange Corporation has created this simple Capital Gain Analysis Form and Calculator to estimate the tax impact if a property is sold and not exchanged, and to calculate the reinvestment requirements for a tax-free exchange. 1031 Exchange Excel Spreadsheet: Optimal Resolution List - UpdateTrader List the best pages for the search, 1031 Exchange Excel Spreadsheet. All the things about 1031 Exchange Excel Spreadsheet and its related information will be in your hands in just a few seconds. 1031 Exchange Excel Spreadsheet: Optimal Resolution List - UpdateTrader

1031 exchange worksheet excel. 1031 Exchange for Dummies: What Investors NEED to Know! 1. Properties must be "like-kind". To qualify for a 1031 exchange, the relinquished property and the replacement property must be "like-kind.". This sounds like they need to be similar in type, but the IRS defines like-kind broadly. In practice, virtually any two types of real estate are like-kind. About Our Coalition - Clean Air California WebAbout Our Coalition. Prop 30 is supported by a coalition including CalFire Firefighters, the American Lung Association, environmental organizations, electrical workers and businesses that want to improve California’s air quality by fighting and preventing wildfires and reducing air pollution from vehicles. Microsoft takes the gloves off as it battles Sony for its Activision ... Web12/10/2022 · Microsoft is not pulling its punches with UK regulators. The software giant claims the UK CMA regulator has been listening too much to Sony’s arguments over its Activision Blizzard acquisition. The Ultimate Partial 1031 Boot Calculator (Avoid Boot!) In a partial 1031 exchange, "boot" refers to any leftover sale proceeds subject to tax. Boot results from a difference in value between the original property, known as the relinquished property, and the replacement property. When the replacement property has a lower value than the sale price of the relinquished property, that difference is ...

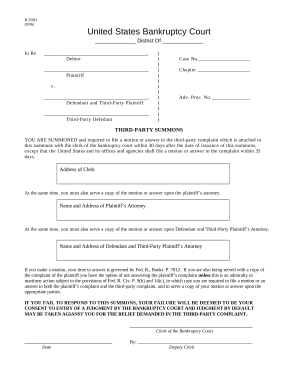

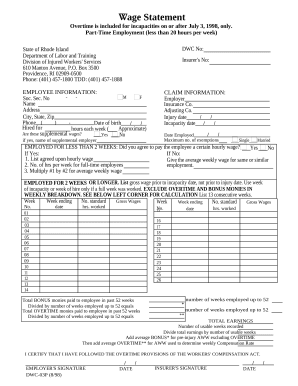

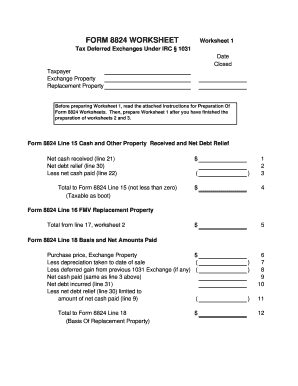

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses HUD-1 Line # A. Exchange expenses from sale of Old Property Commissions $_____ 700 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 Excel 2016 Bible | Wiley WebThe complete guide to Excel 2016, from Mr. Spreadsheet himself Whether you are just starting out or an Excel novice, theExcel 2016 Bible is your comprehensive, go-to guide for all your Excel 2016 needs. Whether you use Excel at work or at home, you will be guided through the powerful new features and capabilities by expert author and Excel Guru John … Microsoft is building an Xbox mobile gaming store to take on … Web19/10/2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games. Library of 1031 Exchange Forms Visit our library of important 1031 exchange forms. The pros at Equity Advantage have provided everything you need in easily downloadable PDF files. 800-735-1031 info@1031exchange.com

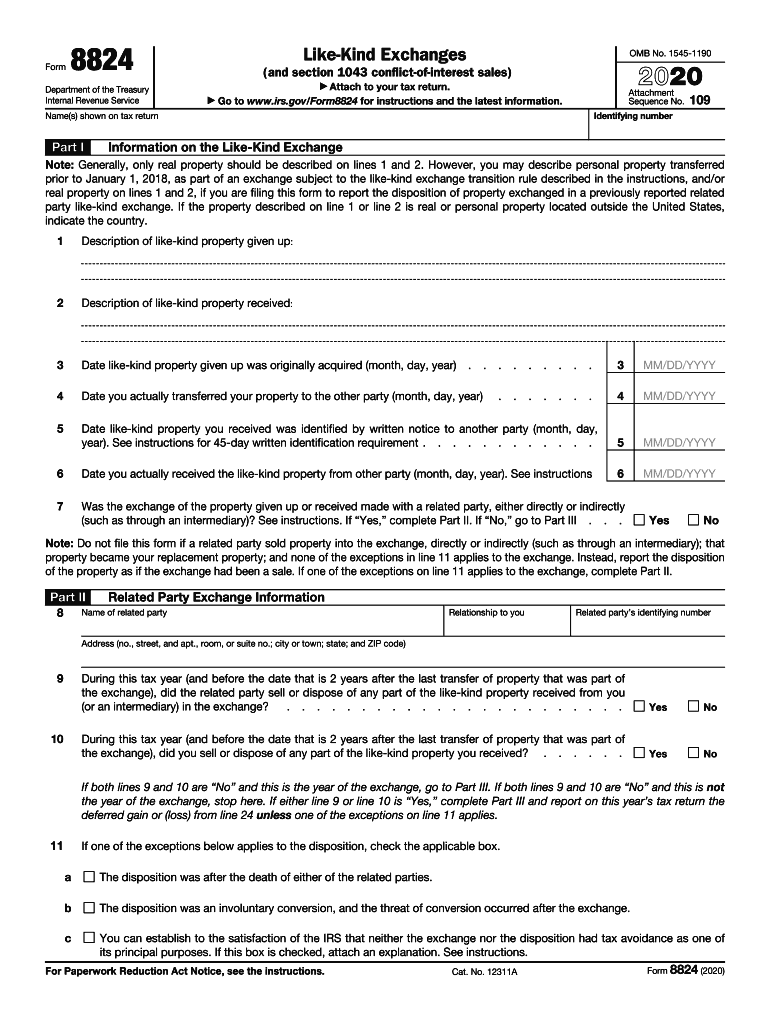

1031 Exchange Worksheet Excel And Example Of Form 8824 Filled Out 1031 Exchange Worksheet Excel And Example Of Form 8824 Filled Out Worksheet April 17, 2018 We tried to get some amazing references about 1031 Exchange Worksheet Excel And Example Of Form 8824 Filled Out for you. Here it is. It was coming from reputable online resource which we enjoy it. We hope you can find what you need here. 1031 Exchange Calculator - The 1031 Investor 1031 Exchange Calculator This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received). Get the free 1031 exchange worksheet 2019 form - pdfFiller Get the free 1031 exchange worksheet 2019 form Get Form Show details Fill 1031 exchange calculation worksheet: Try Risk Free Form Popularity 1031 exchange worksheet form Get, Create, Make and Sign 1031 exchange excel spreadsheet download Get Form eSign Fax Email Add Annotation 1031 Exchange Worksheet Excel is not the form you're looking for? 1031 Tool Kit - TM 1031 Exchange Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Informed Decisions Make the Best Investments Thousands of Properties Rated Each Month. Only the Worthiest Investments Make it Into Your Vault. Easily Compare Selected Properties.

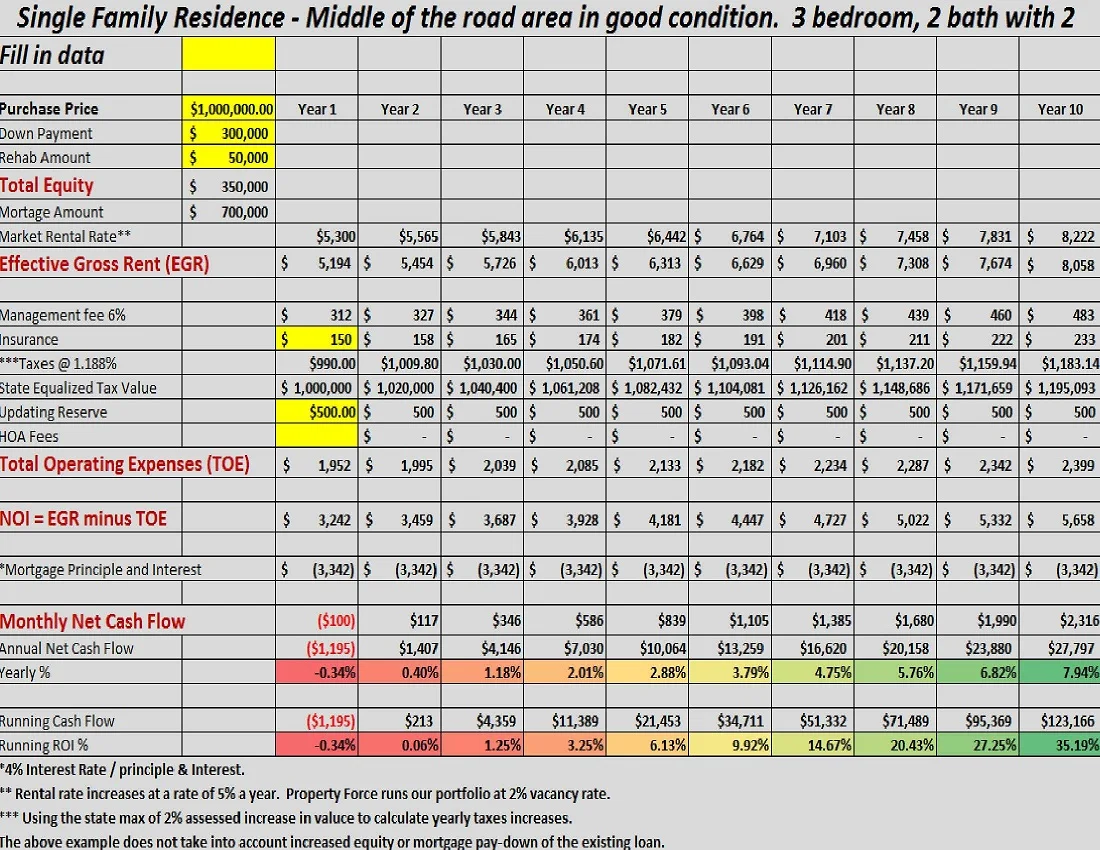

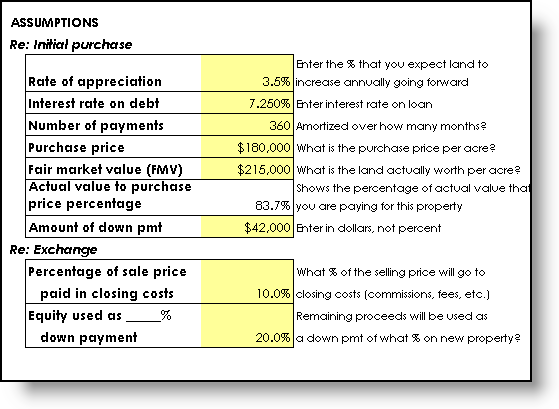

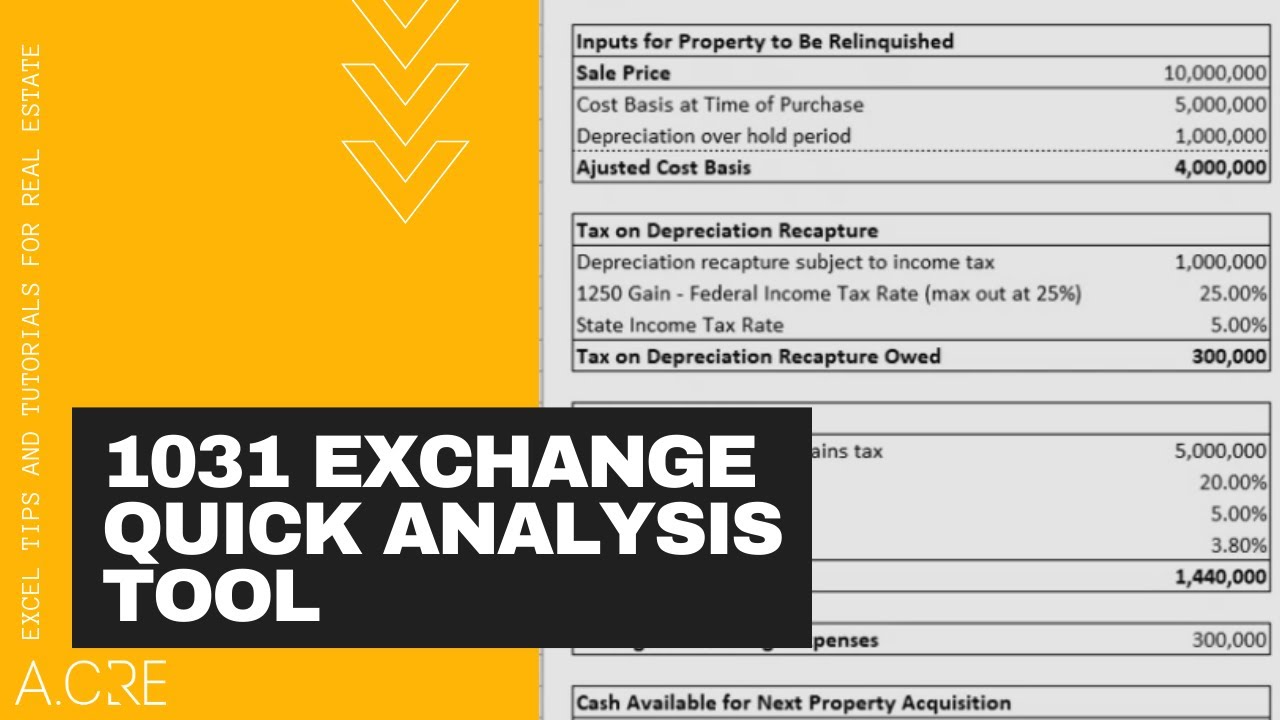

1031 Exchange - Overview and Analysis Tool (Updated Apr 2022) A 1031 Exchange, or Like-kind Exchange, is a strategy in which a real estate investor can defer both capital gains tax and depreciation recapture tax upon the sale of a property and use that money, which has not been taxed, to purchase a like-kind property.

Like-Kind Exchange Worksheet - Thomson Reuters This tax worksheet examines the disposal of an asset and the acquisition of a replacement "like-kind" asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. ... like a primary residence or a second home or vacation home, does not qualify for like-kind exchange treatment. Both ...

Philippines - Wikipedia WebThere is evidence of early hominins living in what is now the Philippines as early as 709,000 years ago. A small number of bones from Callao Cave potentially represent an otherwise unknown species, Homo luzonensis, that lived around 50,000 to 67,000 years ago. The oldest modern human remains found on the islands are from the Tabon Caves of …

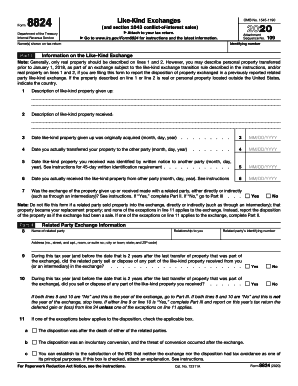

Form 8824: Do it correctly | Michael Lantrip Wrote The Book FORM 8824, THE 1031 EXCHANGE FORM The combination of the HUD-1 and the information on our Capital Gains Tax page will be all that you need for the completion of the form. For review, we are dealing with the following scenario. FORM 8824 EXAMPLE Alan Adams bought a Duplex ten years ago for $200,000 cash. He assigned a value of $20,000 to the land.

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses A. Exchange expenses from sale of Old Property Commissions $_____ Loan fees for seller _____ Title charges _____ ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

Form 8824 - 1031 Corporation Exchange Professionals We hope that this worksheet will help with these reporting issues that present difficulties in reporting 1031 Exchanges. However, we recognize that almost all Exchanges are different and that this worksheet might or might not work for any given Exchange. It is offered as a possible tool for the use of our clients and their tax professionals.

1031 Exchange Calculator - Penn's Grant Realty Corporation We'll be happy to help you with calculating your 1031 Exchange, please give us a call 215-489-3800. Enter the following information and our calculator will provide you an idea of how a 1031 exchange will work in your situation. Note that you can see all of the calculations so you can better understand how the final figures were calculated.

Instructions for Form 8824 (2022) | Internal Revenue Service The final regulations, which apply to like-kind exchanges beginning after December 2, 2020, provide a definition of real property under section 1031, and address a taxpayer's receipt of personal property that is incidental to real property the taxpayer receives in the exchange. See Regulation sections 1.1031 (a)-1, 1.1031 (a)-3, and 1.1031 (k)-1.

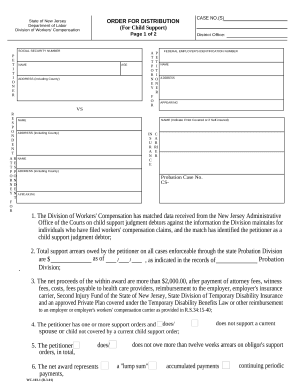

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 303-402-1031 (Local) 888-367-1031 (Toll Free) . FORM 8824 WORKSHEET Worksheet 2 Tax Deferred Exchanges Under IRC § 1031 ANALYSIS OF CASH BOOT RECEIVED OR PAID ... Plus exchange expenses paid (worksheet 3) 19 Total cash paid (line 17 minus line 18 plus line 19) 20

1031 Exchange Examples | 2022 Like Kind Exchange Example By utilizing a 1031 exchange, Ron and Maggie may defer 37.3% in taxes and preserve all of the profit from the sale of their property. This means they have more than $600,000 in additional equity to reinvest! How Much Time do I Have? There are two critical deadlines; If you miss either, you will owe taxes.

May 2021 National Occupational Employment and Wage Estimates Web31/03/2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site.

1031 Like Kind Exchange Calculator - Excel Worksheet WebDownload the free like kind exchange worksheet. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a property. Search This Site . Smart 1031 Exchange Investments. We don't think 1031 exchange investing should be so difficult. That's why we're giving you the same 1031 exchange calculator our exchange experts …

PDF 2019 Exchange Reporting Guide - 1031 Corp Excel spreadsheet to help you with the preparation of IRS Form 8824 "LikeKind Exchanges." If - you would like a copy of this copyrighted spreadsheet, please provide us with your email address ... A 1031 exchange must be reported for the tax year in which the exchange was initiated through

1031 Exchange Experts Equity Advantage | 800.735.1031 A 1031 Exchange is an IRS-authorized process where like-kind business or investment properties are exchanged without immediate tax liability to the property owner (Exchangor). The IRS requires that an Exchangor use a neutral third party, known as an intermediary or accommodator, to facilitate a 1031 Tax Free Exchange.

1031 Exchange Worksheet - Pruneyardinn The 1031 Exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. This can be done on any operating system, including Windows and Macs. There are many different kinds of formats you can work with when you use the worksheet.

IRC 1031 Like-Kind Exchange Calculator This calculator will help you to determine how much tax deferment you can realize by performing a 1031 tax exchange instead of a taxable sale. We also offer a 1031 deadline calculator. For your convenience we list current Boydton mortgage rates to help real estate investors estimate monthly loan payments & find local lenders. Calculator Rates

Microsoft says a Sony deal with Activision stops Call of Duty … Web21/10/2022 · A footnote in Microsoft's submission to the UK's Competition and Markets Authority (CMA) has let slip the reason behind Call of Duty's absence from the Xbox Game Pass library: Sony and

PDF Home - Realty Exchange Corporation | 1031 Qualified Intermediary Home - Realty Exchange Corporation | 1031 Qualified Intermediary

PPIC Statewide Survey: Californians and Their Government Web26/10/2022 · Key findings include: Proposition 30 on reducing greenhouse gas emissions has lost ground in the past month, with support among likely voters now falling short of a majority. Democrats hold an overall edge across the state's competitive districts; the outcomes could determine which party controls the US House of Representatives. Four in …

ExcelExchanges 1031 Exchange - Excel Title Services Who we are: ExcelExchanges is a 1031 exchange facilitator committed to providing professional client service, efficiency, value, reliability and peace of mind. Our team of tax attorneys and professionals structure, coordinate and document 1031 exchanges for clients across the country. Our services include:

1031 Exchange Excel Spreadsheet: Optimal Resolution List - UpdateTrader List the best pages for the search, 1031 Exchange Excel Spreadsheet. All the things about 1031 Exchange Excel Spreadsheet and its related information will be in your hands in just a few seconds. 1031 Exchange Excel Spreadsheet: Optimal Resolution List - UpdateTrader

1031 Exchange Calculator | Calculate Your Capital Gains 1031 Exchange Calculator | Calculate Your Capital Gains Capital Gains Calculator Realty Exchange Corporation has created this simple Capital Gain Analysis Form and Calculator to estimate the tax impact if a property is sold and not exchanged, and to calculate the reinvestment requirements for a tax-free exchange.

1031 Exchange Worksheet Excel: Optimal Resolution List - UpdateTrader List the best pages for the search, 1031 Exchange Worksheet Excel. All the things about 1031 Exchange Worksheet Excel and its related information will be in your hands in just a few seconds.

![2022 Rental Property Analysis Spreadsheet [Free Template]](https://wp-assets.stessa.com/wp-content/uploads/2021/06/13170845/Property_Analysis_Spreadsheet__Stessa_.png)

0 Response to "40 1031 exchange worksheet excel"

Post a Comment