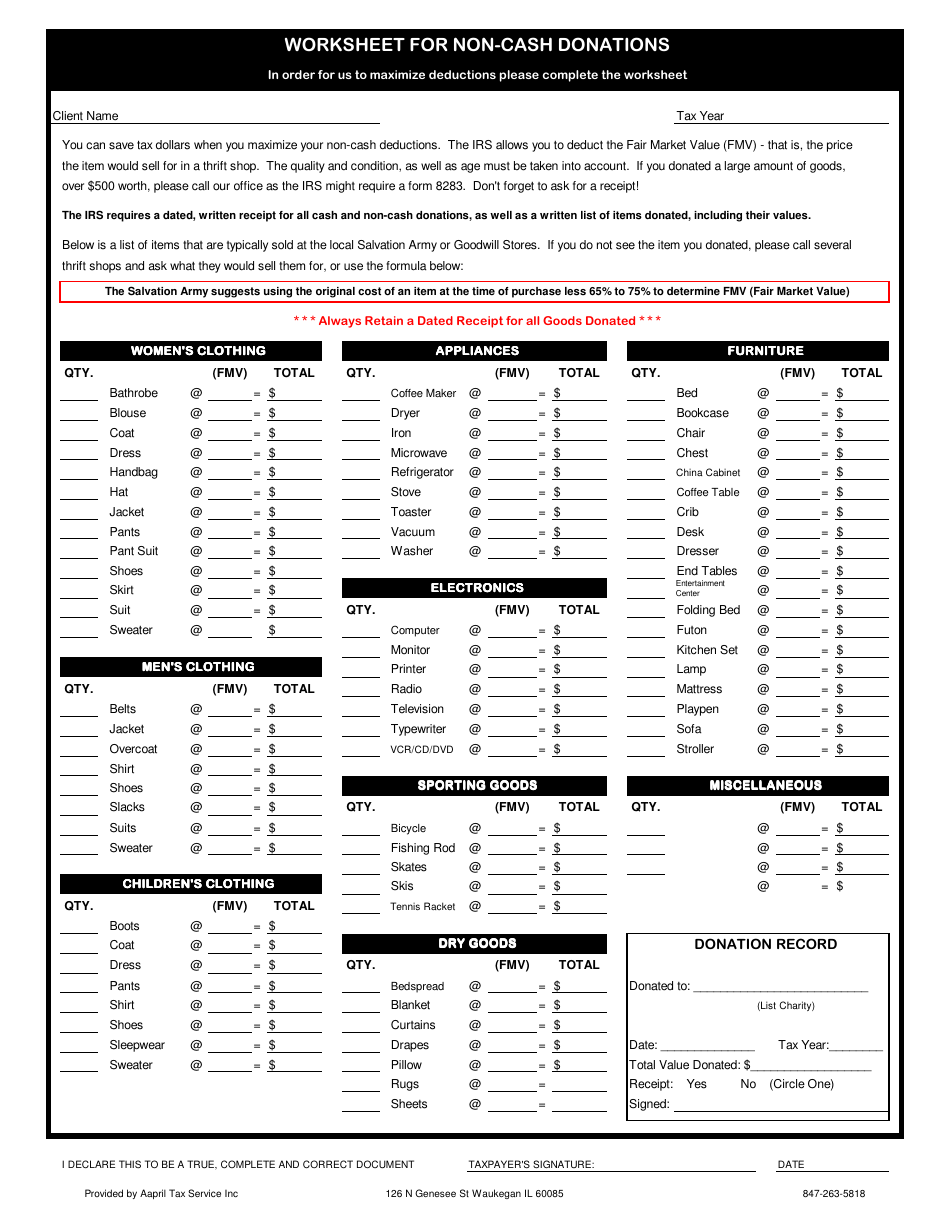

40 non cash charitable donations worksheet

Check Your Free Credit Report & FICO® Score - Experian WebWhether you’re looking to build credit, earn more rewards or get cash back, choose from credit card offers matched to your unique profile so you know they’ll work for you. Check out your matches. Drive down your car insurance costs Shop and compare multiple car insurance quotes from top insurers in minutes. Could Call of Duty doom the Activision Blizzard deal? - Protocol WebOct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

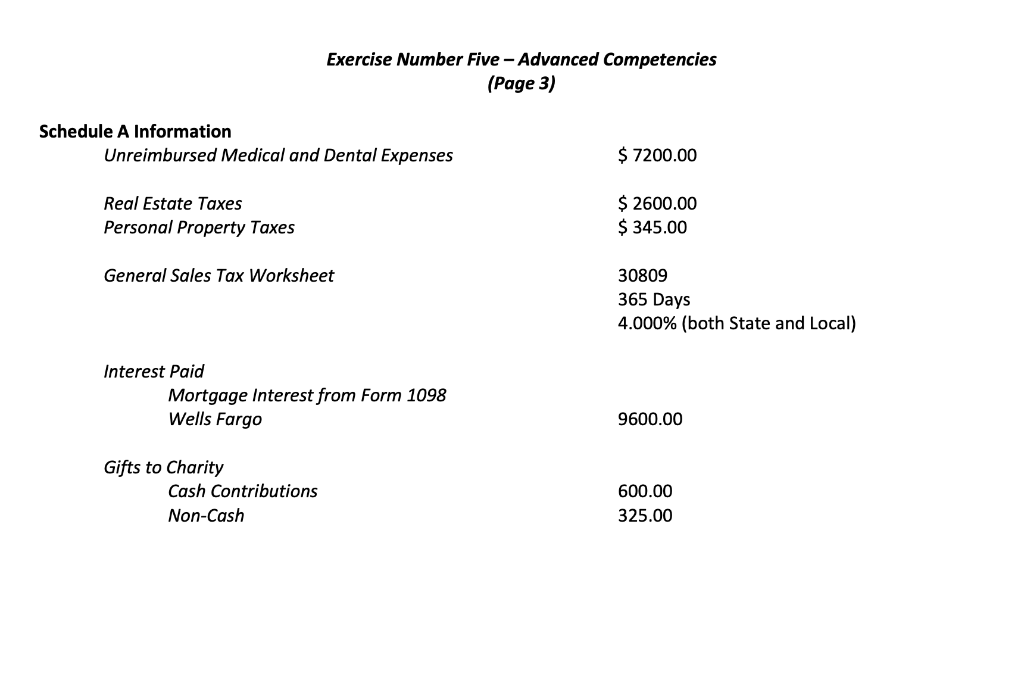

Attach one or more Forms 8283 to your tax return if you WebThis charitable organization acknowledges that it is a qualified organization under section 170(c) and that it received the donated property as described in Section B, Part I, above on the following date Furthermore, this organization affirms that in the event it sells, exchanges, or otherwise disposes of the property described in Section

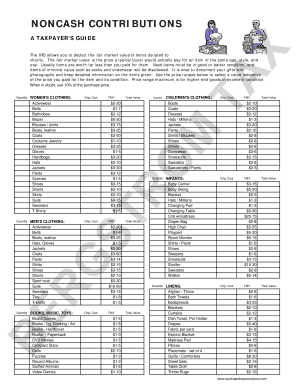

Non cash charitable donations worksheet

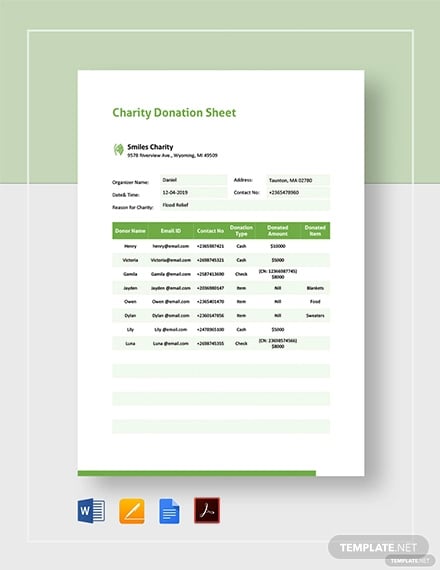

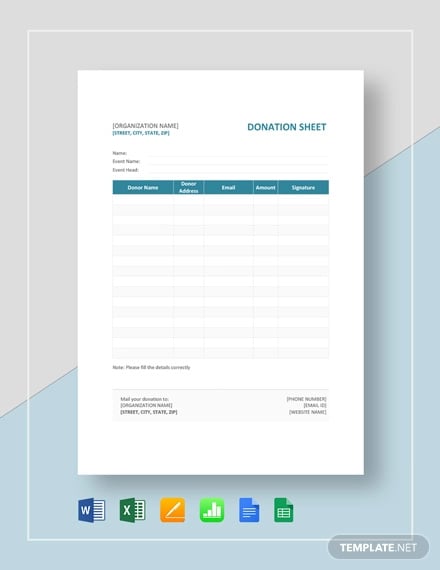

Fill Online, Printable, Fillable, Blank - pdfFiller WebA Non Cash Charitable Contributions/Donations Worksheet is necessary for individuals who make non-cash charitable donations to the Salvation Army that do not exceed $5,000. People in the USA are encouraged to become contributors not only due to the moral virtues inherent to this act, but they will also be to claim corresponding deductions from ... The IRS Donation Limit: What is the Maximum you can Deduct? Jan 07, 2022 · By default, always at least get written confirmation for your donation. I won’t get in to the full details here, since I have previously gone in to depth about cash and non-cash scenarios where you need a charitable donation receipt, appraisal, or no written acknowledgement at all in order to deduct a donation. It’s important, so read up. Donation Value Guide For 2021 | Bankrate WebSep 29, 2021 · If you make a single non-cash gift worth between $250 and $500 (if, for example, you donate a vehicle), you’re required to have a receipt or a written acknowledgment of your gift from a ...

Non cash charitable donations worksheet. TurboTax® Deluxe CD/Download 2022-2023 Tax Software WebDec 05, 2022 · Accurately track and value items you donate to charities including donations such as cash, mileage and stocks. See your ... Form 8283 Non-cash Charitable Contributions. ... Schedule K-1 Worksheet (Form 1041) Estates and Trusts. Schedules K-1 … Publication 526 (2021), Charitable Contributions - IRS tax forms WebSee separate Worksheet instructions. (Keep for your records) 1. Enter fair market value of the donated food _____ 2. Enter basis of the donated food _____ 3. Subtract line 2 from line 1. If the result is zero or less, stop here. Don't complete the rest of this worksheet. Your charitable contribution deduction for food is the amount on line 1 ... Lifestyle | Daily Life | News | The Sydney Morning Herald WebThe latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing Global grants | My Rotary WebGlobal grants have a minimum budget of $30,000 and a maximum World Fund award of $400,000. Grant sponsors can use a combination of District Designated Funds (DDF), cash, and/or directed gifts and endowment earnings to fund a global grant. The Foundation will provide an 80 percent World Fund match for all DDF contributions.

Donation Value Guide For 2021 | Bankrate WebSep 29, 2021 · If you make a single non-cash gift worth between $250 and $500 (if, for example, you donate a vehicle), you’re required to have a receipt or a written acknowledgment of your gift from a ... The IRS Donation Limit: What is the Maximum you can Deduct? Jan 07, 2022 · By default, always at least get written confirmation for your donation. I won’t get in to the full details here, since I have previously gone in to depth about cash and non-cash scenarios where you need a charitable donation receipt, appraisal, or no written acknowledgement at all in order to deduct a donation. It’s important, so read up. Fill Online, Printable, Fillable, Blank - pdfFiller WebA Non Cash Charitable Contributions/Donations Worksheet is necessary for individuals who make non-cash charitable donations to the Salvation Army that do not exceed $5,000. People in the USA are encouraged to become contributors not only due to the moral virtues inherent to this act, but they will also be to claim corresponding deductions from ...

0 Response to "40 non cash charitable donations worksheet"

Post a Comment