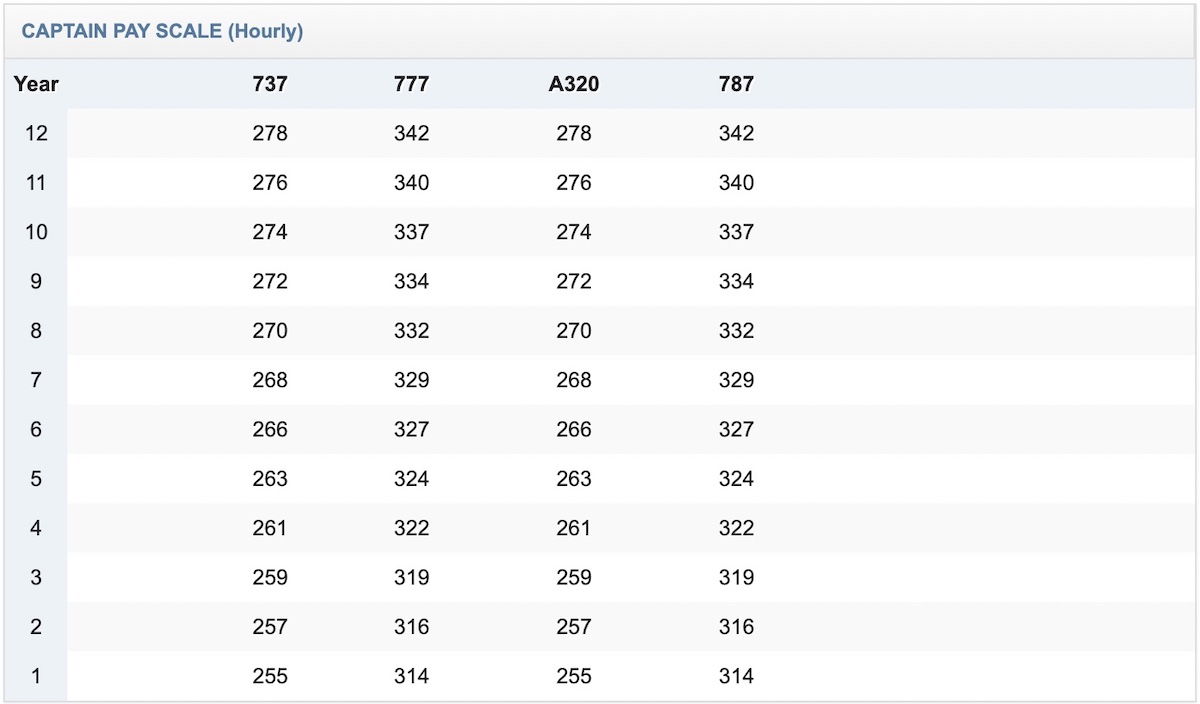

41 airline pilot tax deduction worksheet

Pilots Tax Refund Guide One Flat Rate Expense Allowance gives pilots tax relief on uniform and other equipment ... Navigation flight computer (CRP5); Sunglasses; Atlas; Calculator ... Airline Professional - Tax Deduction Worksheet Association Dues. Tax Deduction Worksheet For. Pilots, Flight Attendants, & Other Airline Personnel. Dry Cleaning. Curling Iron - Portable, Multi-voltage.

Pilots – income and work-related deductions | Australian Taxation ... Aug 18, 2022 ... Allowances not on your income statement or payment summary · include the allowance as income in your tax return · claim a deduction for your ...

Airline pilot tax deduction worksheet

Pilot Tax Return and Deduction Checklist - H&R Block Australia Learn more about the tax deductions commercial and private airline pilots can claim during tax time. Includes information on what you can and cannot claim, ... Downloads - Pilot-Tax Feb 28, 2022 ... If you live in AL, AR, CA, HI, NY, MN or PA your state will allow Flight Deductions. We will need the completed “Flight Deduction Organizer” ... Tax Deductions for Airline Flight Crew Personnel Educational expenses are deductible under either of two conditions: (1) your employer requires the education in order for you to keep your.

Airline pilot tax deduction worksheet. Tax Deduction Worksheet for Pilots, Flight Attendants, & Other ... Download, Fill In And Print Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Pdf Online Here For Free. Pilot Professional Deductions - Diamond Financial If both Taxpayer and Spouse are pilots, use an additional Professional Deduction sheet. DO NOT combine expenses on this form! AIRLINE EMPLOYEED BY:. Tax Deductions for Airline Flight Crew Personnel Tax Deductions for Airline Flight Crew Personnel. Professional Fees & Dues: Dues paid to professional societies related to your occupation are deductible. 25 examples! What can flight crews write off? Why or why not? Here are 25 examples of flight crew tax deductions that flight crews might or ... Expense example 4: A pilot wishes to write off the business portion of his ...

Tax Deductions for Airline Flight Crew Personnel Educational expenses are deductible under either of two conditions: (1) your employer requires the education in order for you to keep your. Downloads - Pilot-Tax Feb 28, 2022 ... If you live in AL, AR, CA, HI, NY, MN or PA your state will allow Flight Deductions. We will need the completed “Flight Deduction Organizer” ... Pilot Tax Return and Deduction Checklist - H&R Block Australia Learn more about the tax deductions commercial and private airline pilots can claim during tax time. Includes information on what you can and cannot claim, ...

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

:max_bytes(150000):strip_icc()/GettyImages-1204778477-880ec3384ffa4ca4ae41e00893758c1d.jpg)

0 Response to "41 airline pilot tax deduction worksheet"

Post a Comment