42 realtor tax deduction worksheet

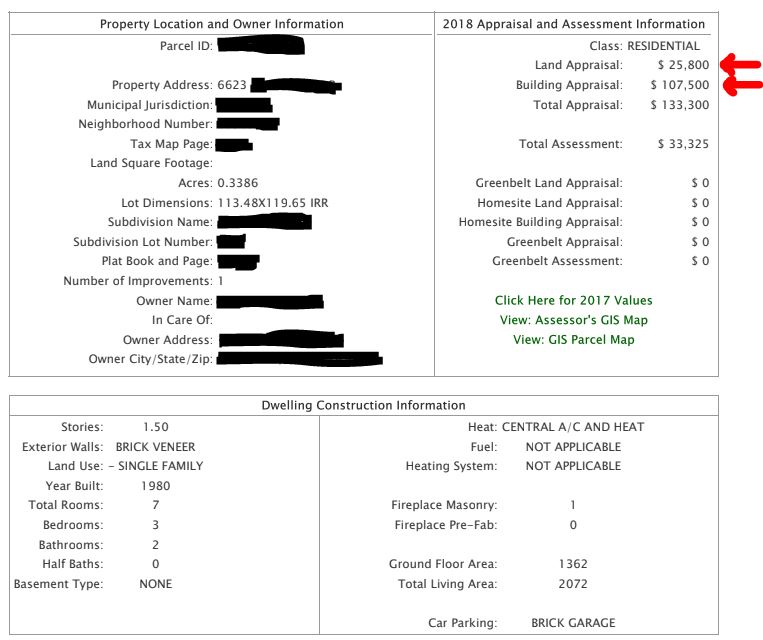

How to claim your senior property tax exemption Apr 15, 2020 · For those who qualify, tax exemptions generally come in four different categories: - Seniors: You may be eligible if you have a limited income and you are at or above a certain age - People with ... Sales Tax Deduction: What It Is, How To Take Advantage - Bankrate Sep 22, 2021 · The sales tax deduction gives taxpayers the opportunity to reduce their tax liability when they deduct state and local sales taxes or state and local income taxes that they paid in 2021 — but ...

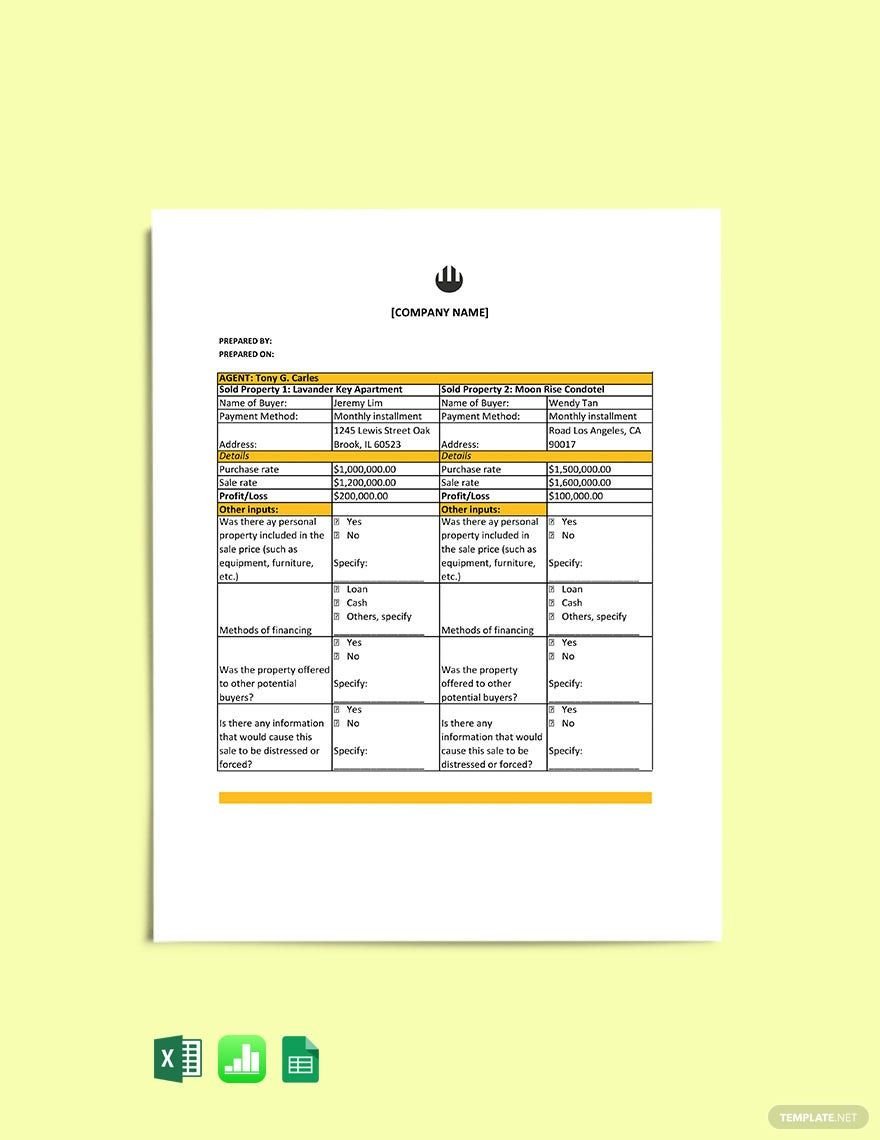

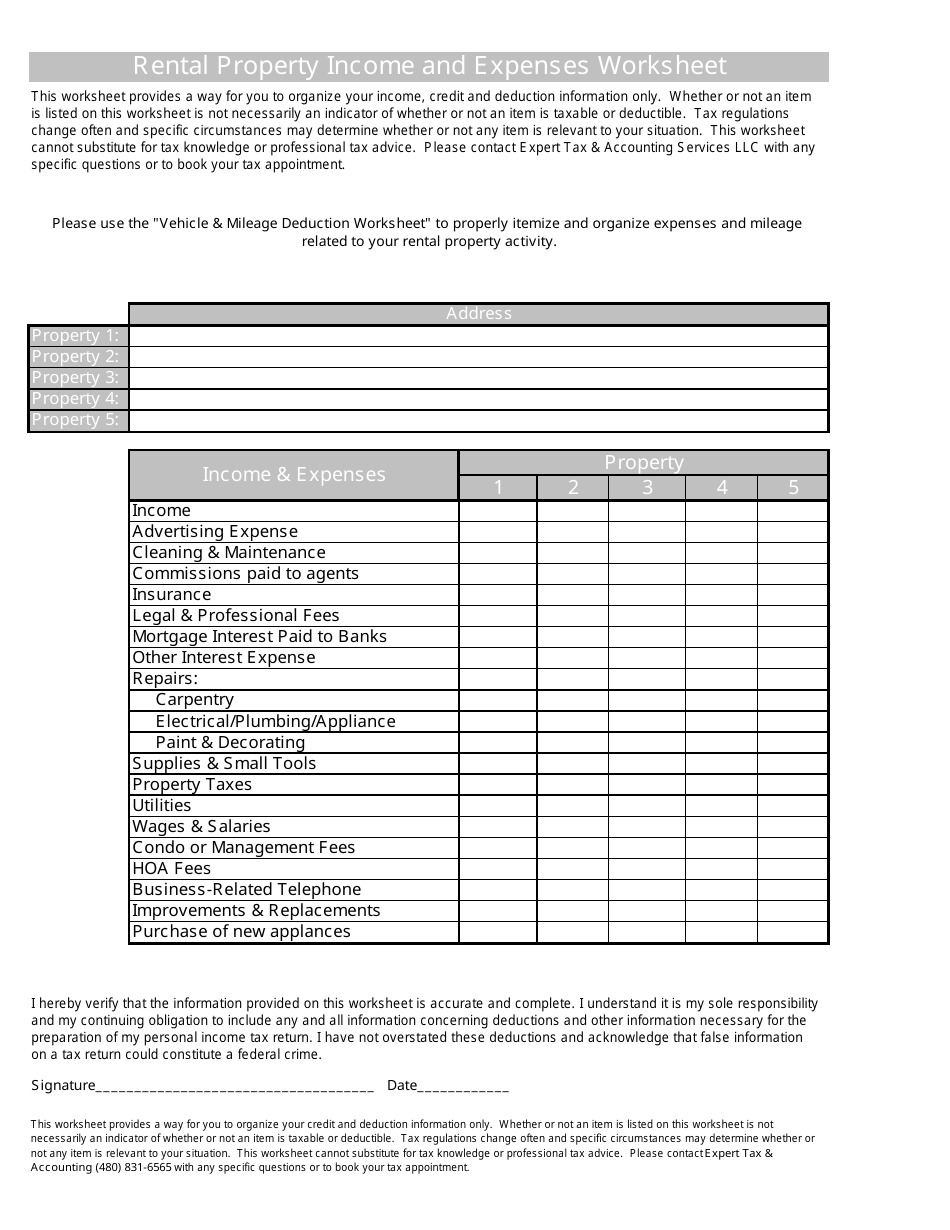

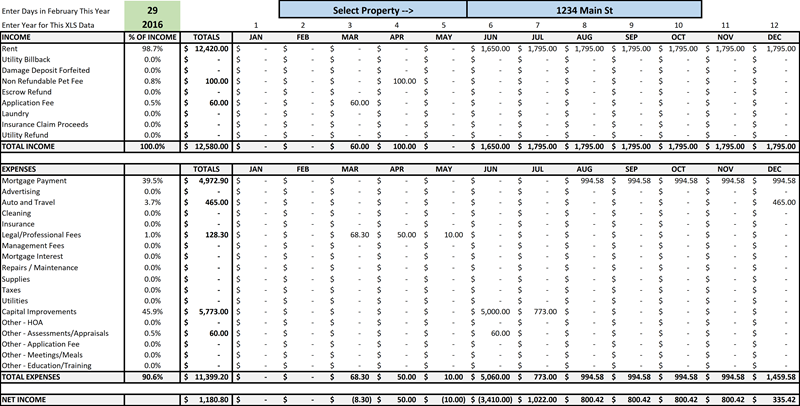

Rental Income and Expense Worksheet - Rentals Resource Center Jan 01, 2021 · To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or HOA dues, gardening service and utilities in the “monthly expense” category.

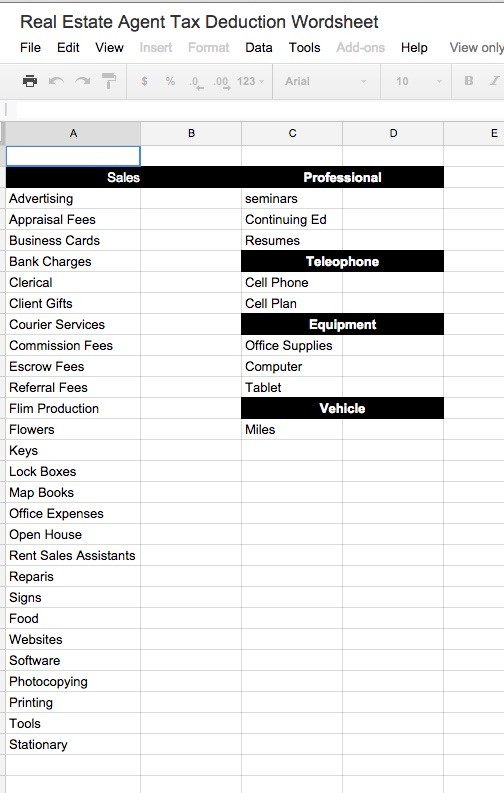

Realtor tax deduction worksheet

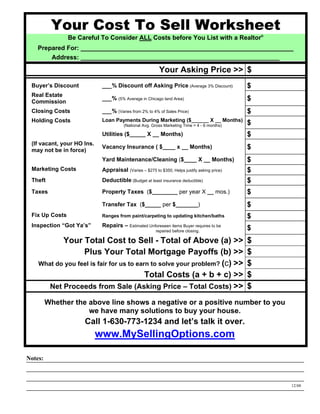

5 Tax Deductions When Selling a Home: Did You Take Them All? Mar 27, 2022 · This deduction is capped at $10,000, Zimmelman says. So if you were dutifully paying your property taxes up to the point when you sold your home, you can deduct the amount you paid in property ... Donation Value Guide For 2021 | Bankrate Sep 29, 2021 · If the total of all your contributed property comes to more than $500, you have to file IRS Form 8283 with your tax return. SHARE: Share this article on Facebook Realtor Tax Deduction Worksheet Form - signNow How to create an electronic signature for the REvaltor Tax Deduction Worksheet Form on iOS devices real estate agent tax deductions worksheet21iPhone or iPad, easily create electronic signatures for signing a rEvaltor tax deduction worksheet form in PDF format. signNow has paid close attention to iOS users and developed an application just for ...

Realtor tax deduction worksheet. Mortgage Learning Center - Zillow Financing Your Dream Home Starts Here. For listings in Canada, the trademarks REALTOR®, REALTORS®, and the REALTOR® logo are controlled by The Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA. Realtor Tax Deduction Worksheet Form - signNow How to create an electronic signature for the REvaltor Tax Deduction Worksheet Form on iOS devices real estate agent tax deductions worksheet21iPhone or iPad, easily create electronic signatures for signing a rEvaltor tax deduction worksheet form in PDF format. signNow has paid close attention to iOS users and developed an application just for ... Donation Value Guide For 2021 | Bankrate Sep 29, 2021 · If the total of all your contributed property comes to more than $500, you have to file IRS Form 8283 with your tax return. SHARE: Share this article on Facebook 5 Tax Deductions When Selling a Home: Did You Take Them All? Mar 27, 2022 · This deduction is capped at $10,000, Zimmelman says. So if you were dutifully paying your property taxes up to the point when you sold your home, you can deduct the amount you paid in property ...

![2022 Rental Property Analysis Spreadsheet [Free Template]](https://wp-assets.stessa.com/wp-content/uploads/2021/06/13170845/Property_Analysis_Spreadsheet__Stessa_.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

0 Response to "42 realtor tax deduction worksheet"

Post a Comment