42 truck driver expenses worksheet

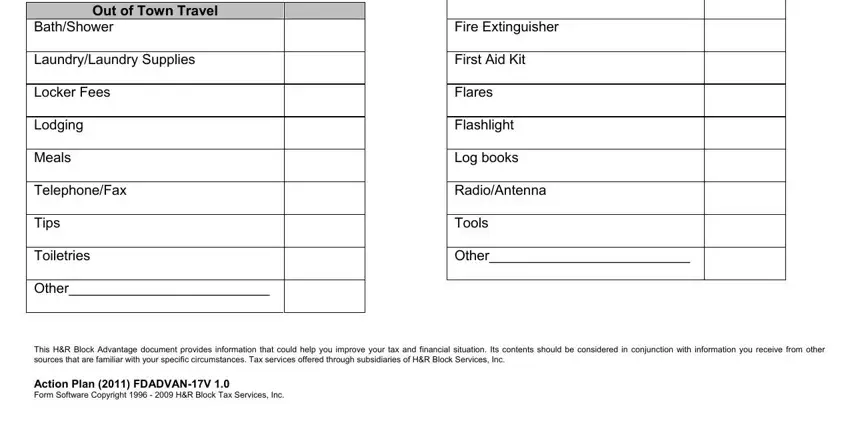

PDF LONG HAUL/OVERNIGHT TRUCK DRIVER DEDUCTIONS - FormsPal LONG HAUL/OVERNIGHT TRUCK DRIVER DEDUCTIONS The purpose of this worksheet is to help you organize your tax deductible business expenses. In order for an expense to be deductible, it must be considered an "ordinary and necessary" expense for your business or profession. You may be able to deduct other expenses that are not listed below. PDF FEDERAL TAXES and O-T-R & O-O TRUCKERS DEDUCTIONS LIST - Trucker to Trucker Non-Deductible Expenses Short List on Business Return (1) Expenses that were reimbursed by your employer(…ask your tax pro whether you are obligated to claim such reimbursements for business-related expenses in whole or in part…especially items like reimbursed fines or penalties paid by you but reimbursed back to you byemployer).

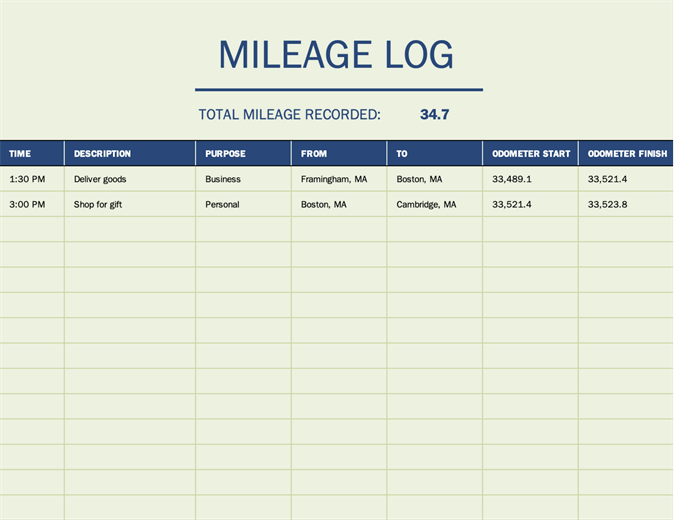

PDF PDF document created by PDFfiller - cdn.cocodoc.com Mileage Log Vehicle_____ _____ Date Odometer Start From To Odometer End Total Miles Parking , etc.

Truck driver expenses worksheet

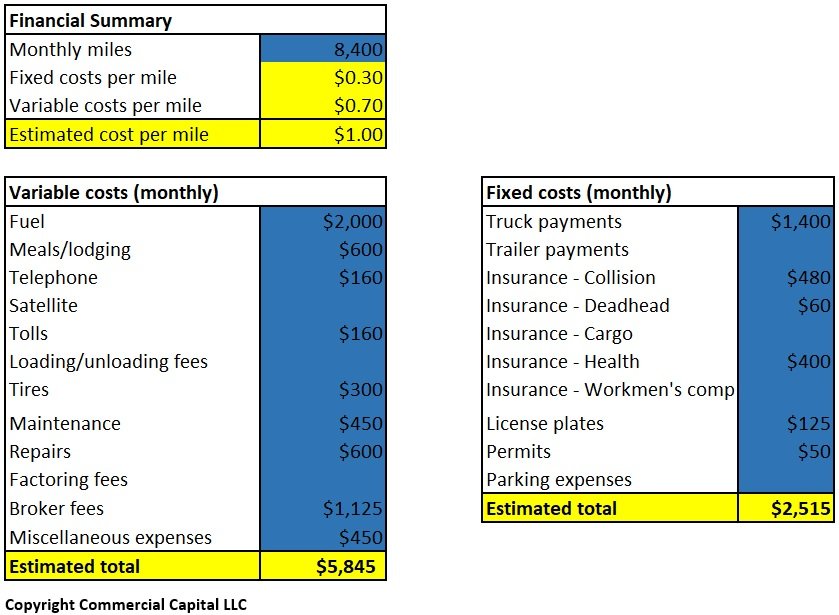

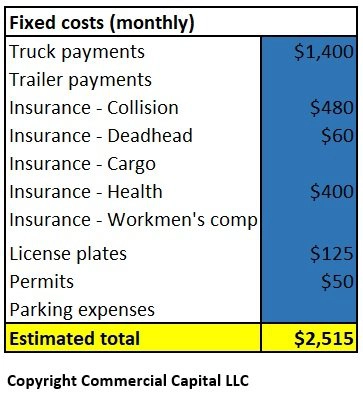

Truck Driver Expenses Worksheet Form - Fill Out and Sign Printable PDF ... Use a Truck Driver Expenses Worksheet template to make your document workflow more streamlined. Show details How it works Open form follow the instructions Easily sign the form with your finger Send filled & signed form or save Rate form 4.3 Satisfied 36 votes be ready to get more Create this form in 5 minutes or less Get Form PDF Truck Driver Worksheet RENT/LEASE: Truck lease WAGES: 9lrin~ourffi~fil' ave en of W-2s/941 s if they 1 e Machinery and equipment Wages to spouse (subjectto Soc.Sec. and Other bus. property, locker fees Medicare tax) REPAIRS & MAINTENANCE: Truck, equipment, Children under 18 (not subjectto etc. Soc.Sec. and Medicare tax) SUPPLIES: Maps, safety supplies Truck Driver Expenses: Overview, Deductions & Best Practices Truck expenses depend on whether you are buying a truck or leasing it. When you are buying a used truck, you can expect to pay around $50,000 to $140,000 and around $80,000 to $200,000 for a new semi-truck. Freightliner Cascadia Trucks can also be leased for drivers who don't want to make a large initial investment.

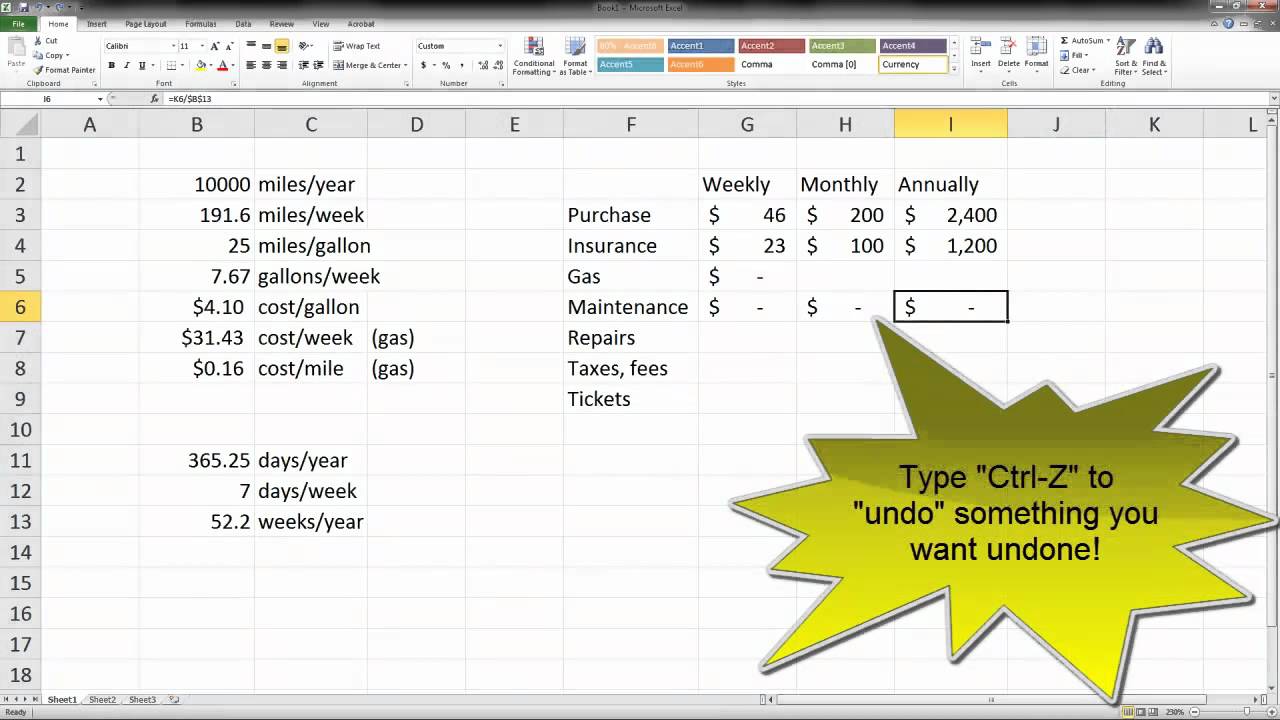

Truck driver expenses worksheet. Tax-Deductible Car and Truck Expenses - The Balance Small Business Deducting Your Actual Expenses. You have two options for deducting car and truck expenses. The first is using your actual expenses, which include parking fees and tolls, vehicle registration fees, personal property tax on the vehicle, lease and rental expenses, insurance, fuel and gasoline, repairs including oil changes, tires, and other ... Truck Driver Deductions Spreadsheet: Fill & Download for Free - CocoDoc Start on editing, signing and sharing your Truck Driver Deductions Spreadsheet online with the help of these easy steps: Push the Get Form or Get Form Now button on the current page to make access to the PDF editor. Wait for a moment before the Truck Driver Deductions Spreadsheet is loaded 31 Best Tax Deductions for Truckers, Truck Drivers & Owner Operators Form 2290 is used by Truck Driver and owner operator truck drivers to calculate their Heavy Highway Use Tax. This tax is based on the amount of travel that a vehicle has done on public roads during the tax year. The rate is $550 per year for vehicles that travel 5,000 miles or less, and $100 for each 1,000 miles over 5,000. Car & Truck Expenses Worksheet: Cost must be entered Car & Truck Expenses Worksheet: Cost must be entered. "schedule C -- Car & Truck Expenses Worksheet: Cost must be entered." Hi everyone, I almost complete my tax return but at the end the program asked me to entered my vehicle cost. There are an empty box next to the question and I need to enter a number before I can file my tax return ...

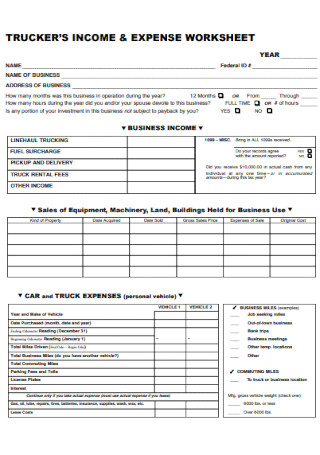

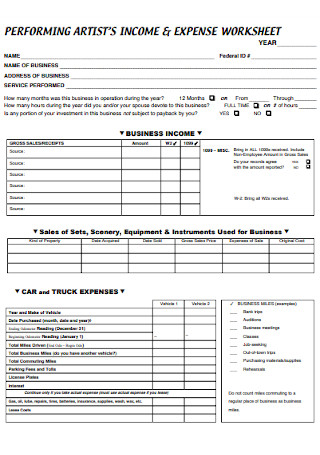

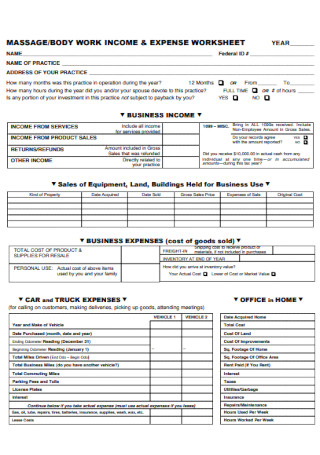

PDF TRUCKER'S INCOME & EXPENSE WORKSHEET!!!!!!!!!!!!!! - Webflow TRUCKER'S INCOME & EXPENSE WORKSHEET!!!!! YEAR_____ NAME ... Continue only if you take actual expense (must use actual expense if you lease) Mfg. gross vehicle weight ... Truck Driver Tax Deductions Visit for more CDL Truck Driver Solutions a spreadsheet for truckdriver expense records. [SOLVED] Re: a spreadsheet for truckdriver expense records. check out the ones at there are a bunch of trucker excel based bookkeeping and ifta programs...very easy to use, work great. Register To Reply Bookmarks Digg del.icio.us StumbleUpon Google Posting Permissions You may not post new threads You may not post replies Complete List Of Owner Operator Expenses For Trucking Depending on the age of your truck, maintenance and repair fees can easily run well over $10,000 annually. And don't forget the cost of washing and cleaning supplies if you're going to keep your truck spotless. Fuel This is the one that can hurt the most. A single fill up of two 150 gallon tanks can run over $1,400. Truck Driver Tax Deductions Worksheet - Fill Online, Printable ... Editing truck driver tax deductions worksheet online Follow the guidelines below to use a professional PDF editor: Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile. Prepare a file. Use the Add New button.

Truck Driver Expenses Worksheet PDF Form - FormsPal This Truck Driver Expenses Worksheet Form can help make the process a little easier. With this form, you can track your mileage, fuel costs, and other expenses. Printing out a copy of this form and keeping it with your receipts can help ensure that you get the most out of your tax return. Truck Driver Expense Spreadsheet | Spreadsheet, Excel spreadsheets ... Feb 10, 2021 - Free Templates Truck Driver Expense Spreadsheet, truck driver expense sheet, tax deduction worksheet for truck drivers, trucking spreadsheet download, owner 19 Truck Driver Tax Deductions That Will Save You Money These expenses include any specialized items you buy to help safely carry your loads. Examples include chains, locks, straps, and even wide-load flags. Tools and equipment If you're like most truckers, you probably carry a tool kit in your truck. Things like hammers, wrenches, pliers, tire irons, and even electrical tape are all deductible. ATBS | Free Owner-Operator Trucker Tools 2022 Per Diem Tracker. Our per diem calendar will help you keep track of your days on the road for the truck driver per diem tax deduction. Write a slash (/) through partial days and an X through full days on the road. Download 2021 Per Diem Tracker. Download 2020 Per Diem Tracker.

Owner Operator Tax Deductions Worksheet - pdfFiller Comments and Help with 2020 truck driver tax deductions worksheet. 00 Taxable 6,000.00 Tax Calculated: Tax: Calculated: Non-taxable — (Add 500.00) 16,500.00 — (Add 2,000.00) 28,500.00 Tax Calculator Example: The Tax Calculator is based on an actual sale of 15,000.00. It has shown you estimated tax of 25,000.00 (Taxable).

Truck Driver Tax Deductions | H&R Block To deduct actual expenses for the truck, your expenses can include (but aren't limited to): Fuel Oil Repairs Tires Washing Insurance Any other legitimate business expense Other unreimbursed expenses you can deduct include: Log books Lumper fees Cell phone that's 100% for business use License and fees for truck and trailer

Spreadsheets | TruckersReport.com Trucking Forum | #1 CDL Truck Driver ... Trucking Jobs in 30 seconds. Every month 400 people find a job with the help of TruckersReport. Zip. Class A CDL Experience. Please select ALL of your current, valid driver's licenses. CDL A CDL B CDL C. Send me job offers. Jul 3, 2021 #2.

Truck Driver Tax Deductions: How to File in 2021 | TFX Vehicle-related expenses. It includes parking fees, truck repairs and maintenance, standard mileage rate, fuel and oil expenses, and more. Cell phones and the internet, GPS. The driving job will be impossible without making calls and checking the road. Licensing fees. You can get a tax refund for licensing and education. Association dues.

What You Need to Know About Truck Driver Tax Deductions Traditional office expenses for your trucking business are deductible. This might include: Postage Paper and pens Calculators Faxing and photocopying Cost of accounting software, such as QuickBooks Personal products A lot of smaller purchases are necessary for life on the road. This might include a: Cooler or minifridge to store food and water

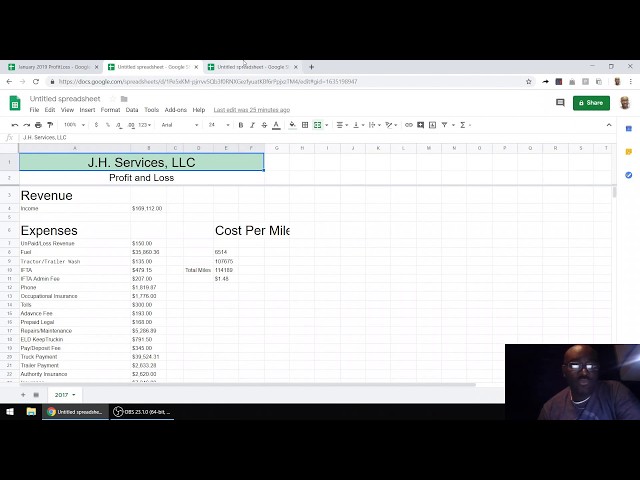

Bookkeeping for Truckers | Free Profit & Loss Statement Template When you become an Apex client we provide you with steady reliable cash flow and many ways to help budget costs with great fuel discounts, tire and maintenance discounts, free membership to our 24/7 Roadside Rescue program, and more! Call 844-827-4524 or get started here.

PDF Car and Truck Expense Deduction Reminders - IRS tax forms using the actual expense method is $1,875 ($2,500 x 75 percent). Recordkeeping. It is important to keep complete records to substantiate items reported on a tax return. In the case of car and truck expenses, the types of records required depend on whether the taxpayer claims the standard mileage rate or actual expenses.

Tax Deductions for Truck Drivers - Jackson Hewitt Meal Allowance. Self-employed truck drivers may also deduct 80% of the special standard meal allowance rate or their actual expenses. The 2018 special standard meal allowance is $63/full day within the US, $68/full day outside the US, $47.25/partial day within the US, $51/partial day outside the US.

Owner Operator Trucking Expenses Spreadsheet - Fill Online, Printable ... Once your trucking expenses spreadsheet form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. ... truck driver expense spreadsheet trucking excel template trucking ...

Truck Driver Tax Deductions Worksheet Form - signNow All you need is smooth internet connection and a device to work on. Follow the step-by-step instructions below to design your truck driver expenses worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature.

PDF Over-the-road Trucker Expenses List - Pstap received as a taxicab driver, or bonuses received as a truck driver in cash, are taxable income. And the sale of any of your equipment or work-related purchases also constitute taxable income (i.e.: sales of tires, radios, etc.). If you are self-employed (unincorporated) and your net earnings after all legitimate deductions are taken are $400 or

Truck Driver Expenses: Overview, Deductions & Best Practices Truck expenses depend on whether you are buying a truck or leasing it. When you are buying a used truck, you can expect to pay around $50,000 to $140,000 and around $80,000 to $200,000 for a new semi-truck. Freightliner Cascadia Trucks can also be leased for drivers who don't want to make a large initial investment.

PDF Truck Driver Worksheet RENT/LEASE: Truck lease WAGES: 9lrin~ourffi~fil' ave en of W-2s/941 s if they 1 e Machinery and equipment Wages to spouse (subjectto Soc.Sec. and Other bus. property, locker fees Medicare tax) REPAIRS & MAINTENANCE: Truck, equipment, Children under 18 (not subjectto etc. Soc.Sec. and Medicare tax) SUPPLIES: Maps, safety supplies

Truck Driver Expenses Worksheet Form - Fill Out and Sign Printable PDF ... Use a Truck Driver Expenses Worksheet template to make your document workflow more streamlined. Show details How it works Open form follow the instructions Easily sign the form with your finger Send filled & signed form or save Rate form 4.3 Satisfied 36 votes be ready to get more Create this form in 5 minutes or less Get Form

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

0 Response to "42 truck driver expenses worksheet"

Post a Comment