43 1040 qualified dividends and capital gains worksheet

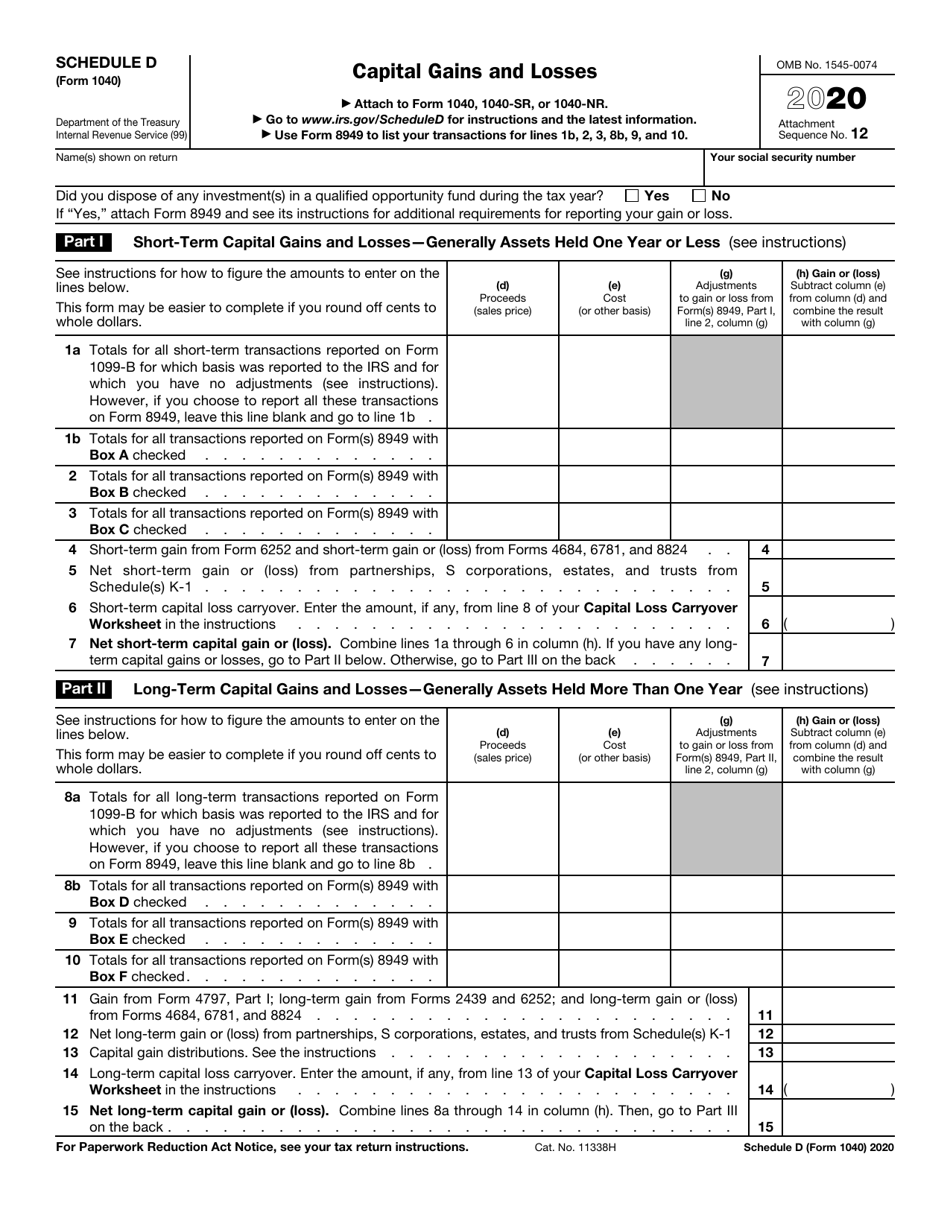

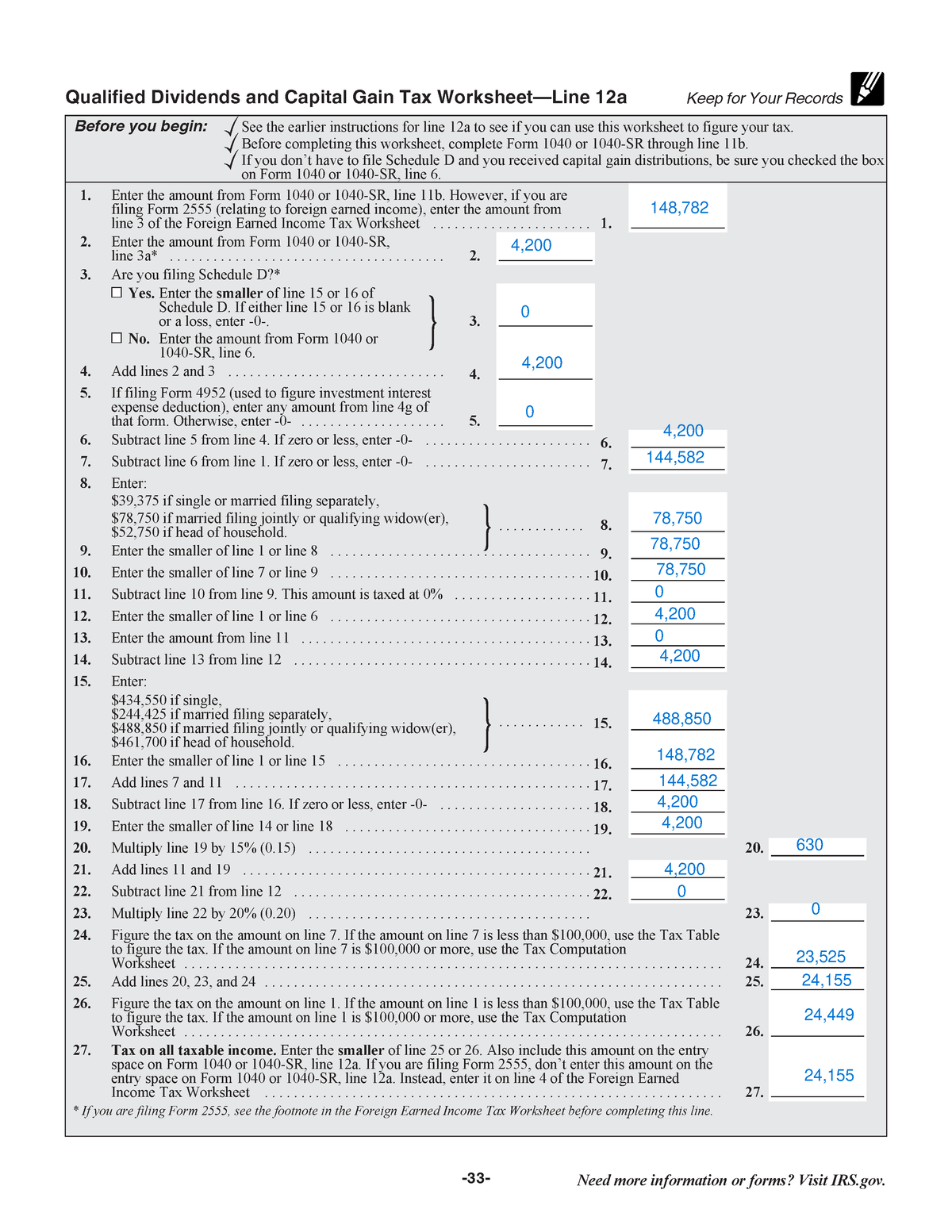

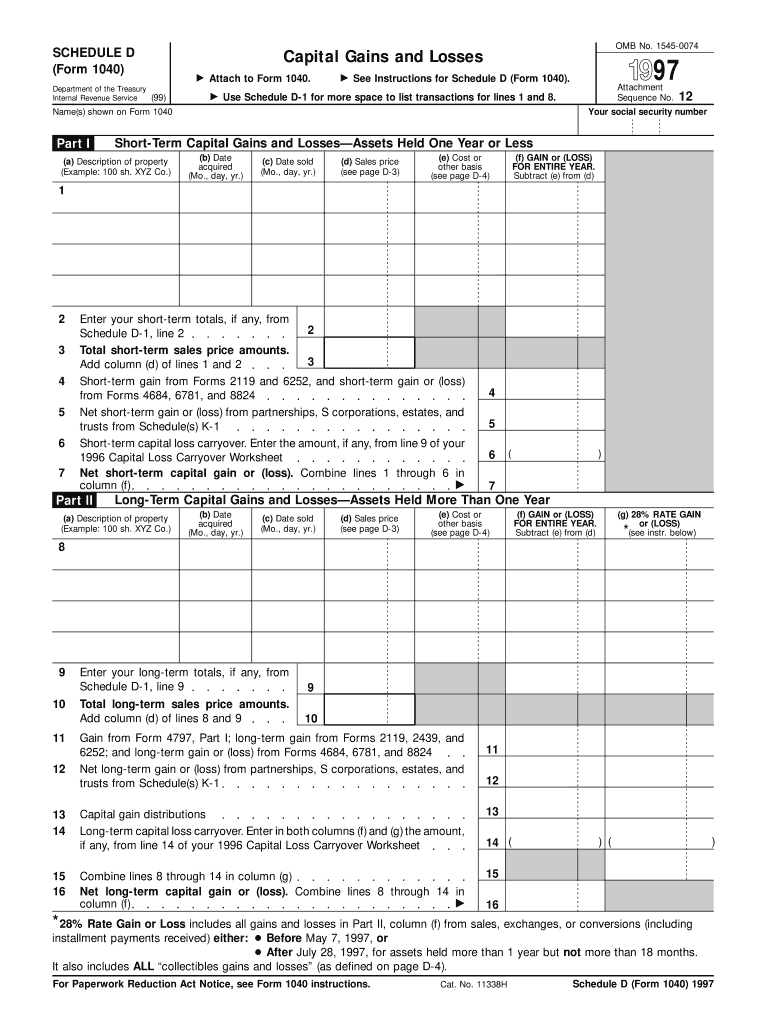

SCHEDULE D Capital Gains and Losses - IRS tax forms Capital Gains and Losses ... Do you have qualified dividends on Form 1040, line 3a, or Form 1040NR, line 10b? Yes. Complete the : Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Form 1040, line 11a (or in the instructions for Form 1040NR, line 42). No. 2022 Instructions for Schedule D (2022) | Internal Revenue Service Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line ...

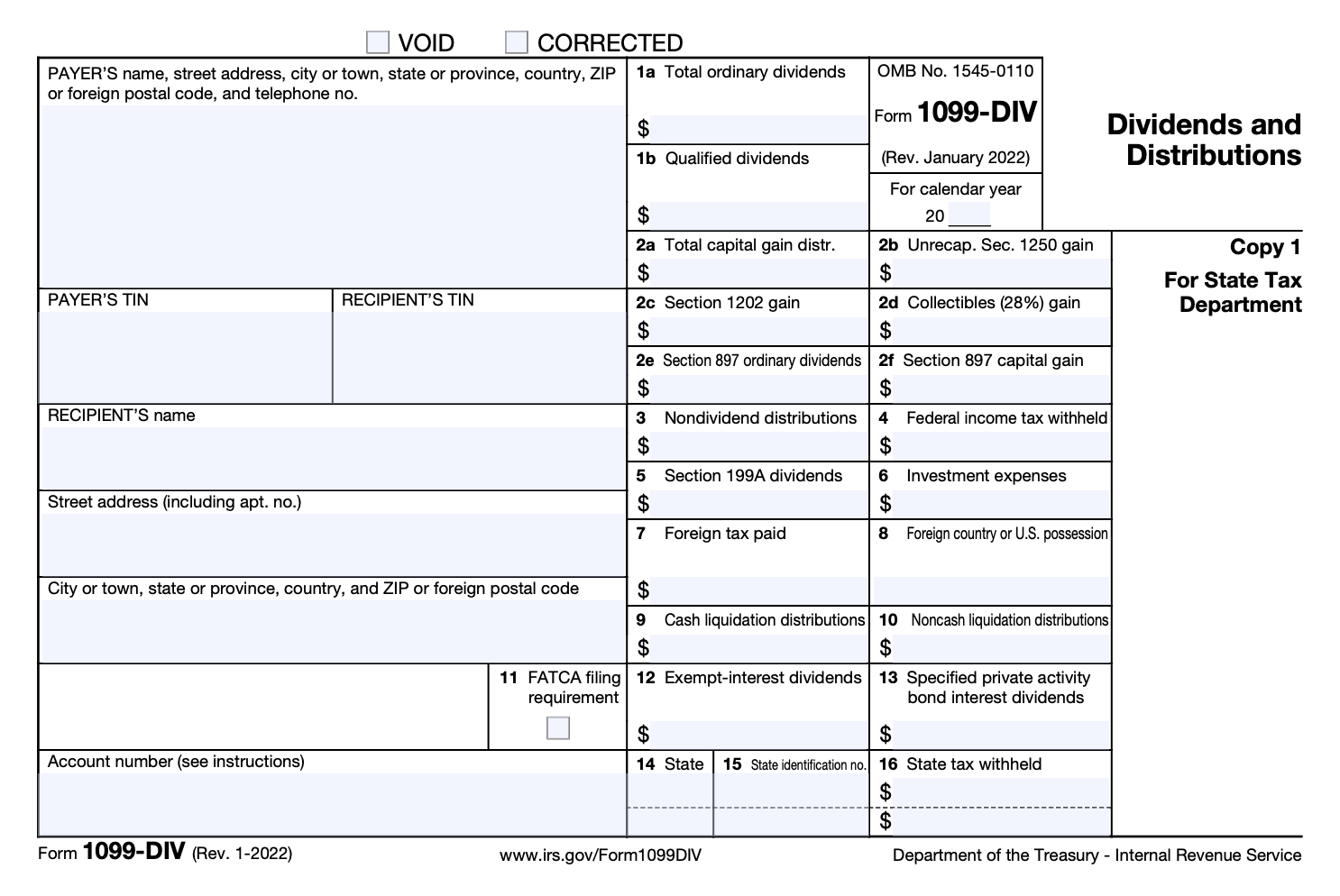

How Dividends Are Taxed and Reported on Tax Returns - The … Nov 15, 2022 · Dividends can be taxed at either ordinary income tax rates or at the lower long-term capital gains tax rates. Dividends that qualify for long-term capital gains tax rates are referred to as "qualified dividends." In 2022, ordinary income tax rates range from 10% and 37% while long-term capital gains tax rate is capped at 20%.

1040 qualified dividends and capital gains worksheet

Publication 3 (2021), Armed Forces' Tax Guide Certain investment income must be $10,000 or less during the year. For most people, this investment income is taxable interest and dividends, tax-exempt interest, and capital gain net income. See Worksheet 1 in Pub. 596 for more information on the investment income includible in the amount that must meet the $10,000 limit. Topic No. 409 Capital Gains and Losses - IRS tax forms Nov 25, 2022 · There are a few other exceptions where capital gains may be taxed at rates greater than 20%: The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate. Net capital gains from selling collectibles (such as coins or art) are taxed at a maximum 28% rate. Qualified Business Income Deduction | Internal Revenue Service REIT/PTP Component. This component of the deduction equals 20 percent of qualified REIT dividends and qualified PTP income. This component is not limited by W-2 wages or the UBIA of qualified property. Depending on the taxpayer’s taxable income, the amount of PTP income that qualifies may be limited depending on the PTP’s trade or business.

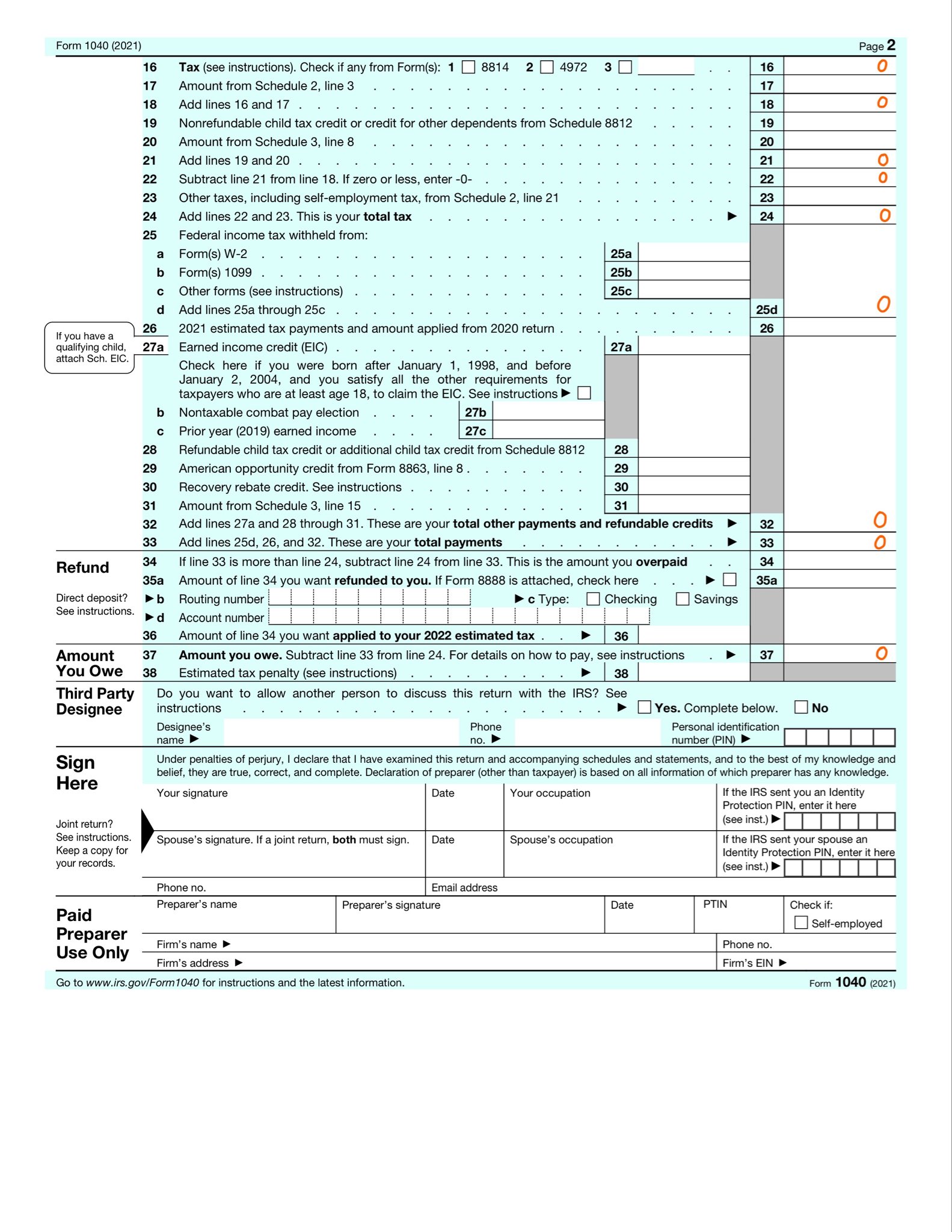

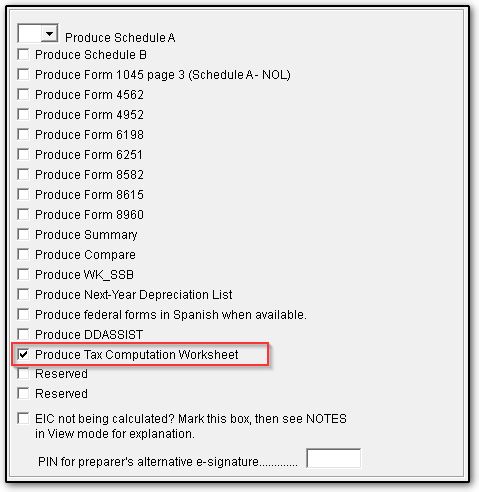

1040 qualified dividends and capital gains worksheet. Publication 502 (2021), Medical and Dental Expenses Jan 13, 2022 · This rule applies even if none or only part of the original cost of the capital asset qualified as a medical care expense. ... (Form 1040), Capital Gains and Losses. For more information about the recovery of an amount that you claimed as ... After completing the Self-Employed Health Insurance Deduction Worksheet in the Instructions for Forms ... Instructions for Form 1040-X (09/2021) | Internal Revenue Service Nov 26, 2021 · Schedule D Tax Worksheet: Sch D: Schedule J (Form 1040) Sch J: Qualified Dividends and Capital Gain Tax Worksheet: QDCGTW: Foreign Earned Income Tax Worksheet: FEITW: Form 8615, Tax for Certain Children Who Have Unearned Income: F8615. Instructions for Schedule I (Form 1041) (2021) Capital gains and qualified dividends. For tax year 2021, the 20% maximum capital gains rate applies to estates and trusts with income above $13,250. The 0% and 15% rates continue to apply to certain threshold amounts. The 0% rate applies to amounts up to $2,700. The 15% rate applies to amounts over $2,700 and up to $13,250. Page 40 of 117 - IRS tax forms 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form …

Qualified Business Income Deduction | Internal Revenue Service REIT/PTP Component. This component of the deduction equals 20 percent of qualified REIT dividends and qualified PTP income. This component is not limited by W-2 wages or the UBIA of qualified property. Depending on the taxpayer’s taxable income, the amount of PTP income that qualifies may be limited depending on the PTP’s trade or business. Topic No. 409 Capital Gains and Losses - IRS tax forms Nov 25, 2022 · There are a few other exceptions where capital gains may be taxed at rates greater than 20%: The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate. Net capital gains from selling collectibles (such as coins or art) are taxed at a maximum 28% rate. Publication 3 (2021), Armed Forces' Tax Guide Certain investment income must be $10,000 or less during the year. For most people, this investment income is taxable interest and dividends, tax-exempt interest, and capital gain net income. See Worksheet 1 in Pub. 596 for more information on the investment income includible in the amount that must meet the $10,000 limit.

:max_bytes(150000):strip_icc()/TermDefinitions_Qualifieddividend_finalv1-9f7e2ee27e0242fabaade0f962d88d8d.png)

0 Response to "43 1040 qualified dividends and capital gains worksheet"

Post a Comment